David Lawant, the head of research for FalconX, an institutional crypto trading platform tailored for financial institutions, recently provided an insightful forecast regarding the future of Bitcoin (BTC) prices in light of the anticipated launch of a spot Bitcoin ETF in the United States. Sharing his via X (previously known as Twitter), he articulated the financial variables that might play a decisive role.

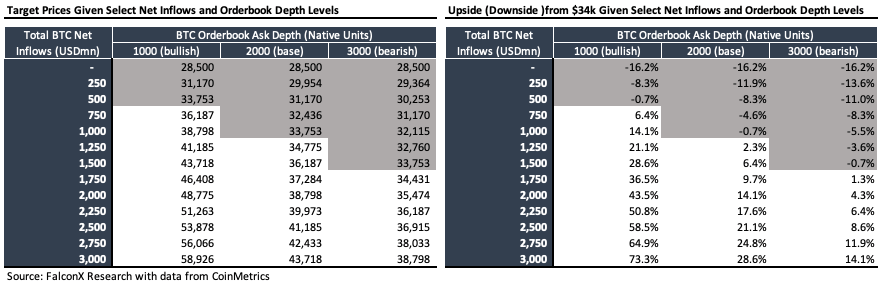

Lawant remarked, “The next significant variable to watch in the spot BTC ETF launch saga will be how much AUM these instruments will gather once they launch. I think the market is currently expecting this inflow to be between $500 million and $1.5 billion.”

The Magic Number To Push Bitcoin Price Past $40,000

The crypto community is keenly anticipating a positive nod for a Spot Bitcoin ETF either at the end of 2023 or the beginning of 2024. A crucial date on the calendar is January 10, 2024, which is set as the final deadline for the ARK/21 Shares application, leading the current series of applications.

Undoubtedly, a green signal from regulatory authorities for the spot ETF will be a game-changer for the entire crypto asset class. Lawant highlighted the importance of this development, stating, “It will open room for large pockets of capital that today can’t properly access crypto, such as financial advisors, and bring a stamp of approval from the world’s most prominent capital markets regulator.”

The pressing question, though, is the immediate impact on capital inflow. “The first couple of weeks after launch will be critical to test how much appetite there is for crypto at the moment in these still relatively untapped pools of capital,” Lawant emphasized.

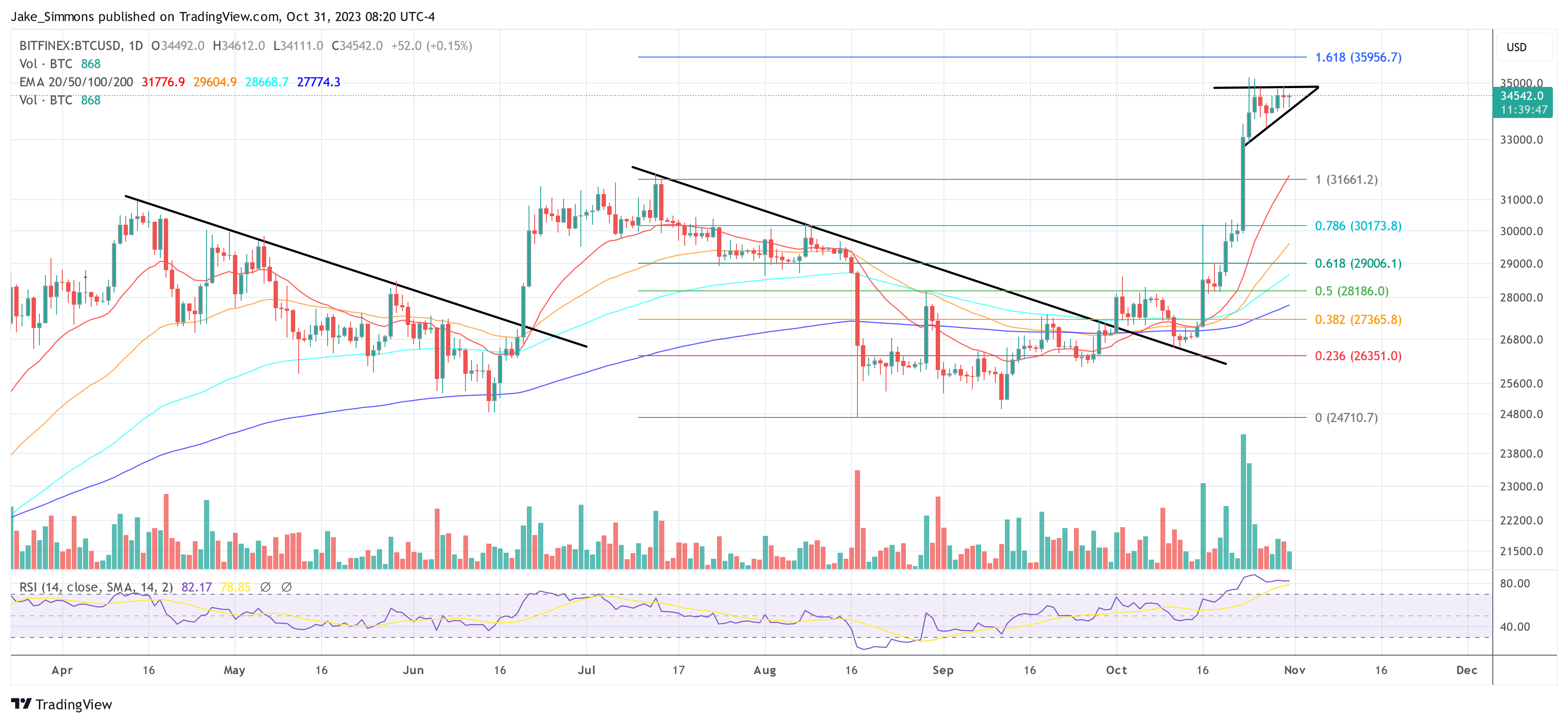

Relying on historical data, Lawant pointed out the stability of the ask side of BTC’s order book, especially for prices situated above the $30,000 mark. This data allows for an approximation of how the inflow of capital might influence the price trajectory of BTC.

Through various inflow scenarios squared against a spectrum of the depth of market scenarios, Lawant deduces that the market is possibly forecasting net inflows ranging between $500 million and $1.5 billion within the initial weeks post-launch.

Drawing conclusions from his analysis, Lawant surmised:

For BTC to establish a new range between the current level and more than $40k, the total net inflows would need to amount to $1.5 billion+. On the other hand, if total net inflows come in below $500 million, we could move back to the $30k level or even below.

However, it’s paramount to note the inherent assumptions in Lawant’s analysis. He admits, “One is that the move from $28.5k to $34.0k was entirely attributed to the market anticipating price-insensitive net inflows from the ETF launch.” This means, among other things, that the current price increase was triggered neither by the correlation with gold nor by the global crises or turmoil in the bond market.

Lawant also highlighted the potential variability in BTC price movement across the order book. Nonetheless, given the stature of issuers like BlackRock, Fidelity, Invesco, and Ark Invest in the SEC queue, the current favorable macroeconomic climate for alternative monetary assets, and prospective improved liquidity conditions, Lawant remains bullish about the potential BTC price rally following the ETF debut. He concluded with, “ceteris paribus I’m still excited about how the BTC price could react to the ETF launch.”

At press time, BTC traded at $34,542.