Recently, a popular crypto trader and YouTuber has a substantial surge in Solana price, forecasting it could reach as high as $360 soon.

This prediction is underpinned by a technical pattern on Solana’s chart—a bullish signal suggesting a potential reversal from bearish to bullish momentum.

Technical Insights Into SOL Potential $360 Rise

According to the trader, CryptoJack on X, SOL has developed a “rounding bottom pattern” over an extended period, indicating it is on the brink of a significant breakout.

Notably, the ’rounding bottom’ pattern, characterized by a gradual decline followed by a stabilizing trend and an upward breakout, is a classic bullish indicator in technical analysis.

CryptoJack’s analysis points out that Solana is setting up for a significant uptick, aiming for a price target double its current value of approximately $146.

Solana formed a rounding bottom pattern over many weeks and is primed for an explosion any moment now.

I entered a Long position on and expect it to break ATHs this year!

— CryptoJack (@cryptojack)

Not only does CryptoJack see a bright future for Solana, but other analysts, such as Altcoin Sherpa, also maintain a bullish stance, with projections of the token potentially surpassing $500 this year.

This would represent a 300% increase from its current level, adding to the 589% growth it has already achieved year-to-date.

Solana Challenges Ethereum

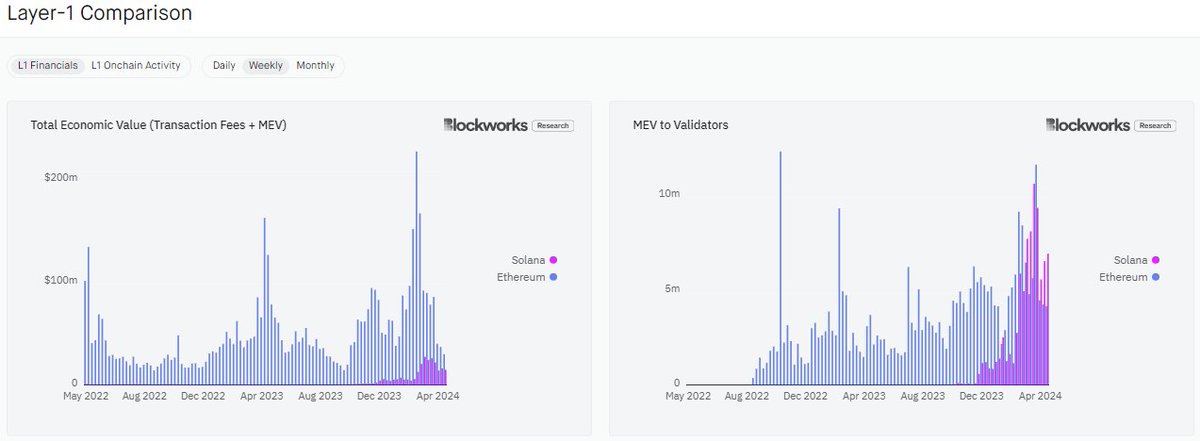

While Solana has shown notable growth, some of its key metrics are also beginning to keep up the pace. Dan Smith, a senior research analyst at Blockworks, suggests that Solana could soon surpass Ethereum regarding transaction fees and capture Maximal Extractable Value (MEV).

Smith’s analysis of X highlights that Solana’s total economic value is nearing Ethereum’s, indicating its increasing relevance in the blockchain space.

Solana will flip Ethereum in transaction fees + captured MEV this month, maybe even this week

— Dan Smith (@smyyguy)

Despite this competition, Ethereum maintains a significant lead in daily transaction fees and total value locked (TVL). In the last 24 hours, Ethereum generated over $2.75 million in fees, compared to Solana’s $1.49 million.

Moreover, according to from DeFillama, Ethereum’s TVL of over $53 billion dwarfs Solana’s $3.96 billion, representing just about 7.2% of Ethereum’s scale.

Meanwhile, Ethereum does not come close to Solana in terms of market performance. Solana has seen quite outstanding growth in the past year, surging by over 500%. On the other hand, Ethereum has only seen a 66% surge over the same period.

Featured image from Unsplash, Chart from TradingView