Bitcoin enthusiasts around the globe can now breathe a collective sigh of relief as the world’s premier cryptocurrency, Bitcoin, rebounds from a recent downturn.

Related Reading

Last week witnessed , akin to the broader market, sliding below the $60,000 mark, primarily due to risk aversion, the US tax season, and escalating geopolitical tensions in the Middle East. However, in a surprising turn of events, Bitcoin has not only recovered but has surged past the $66,000 mark, reigniting optimism and sparking discussions about its future trajectory.

This recent resurgence in Bitcoin’s price comes on the heels of a significant price correction that coincided with April’s highly anticipated Bitcoin halving event. The halving event, a recurring phenomenon in Bitcoin’s protocol, entails a reduction in the rate at which new Bitcoins are mined, effectively halving the supply.

Historically, this event has been associated with heightened market volatility, as some analysts feared that the supply shock could trigger a prolonged sell-off.

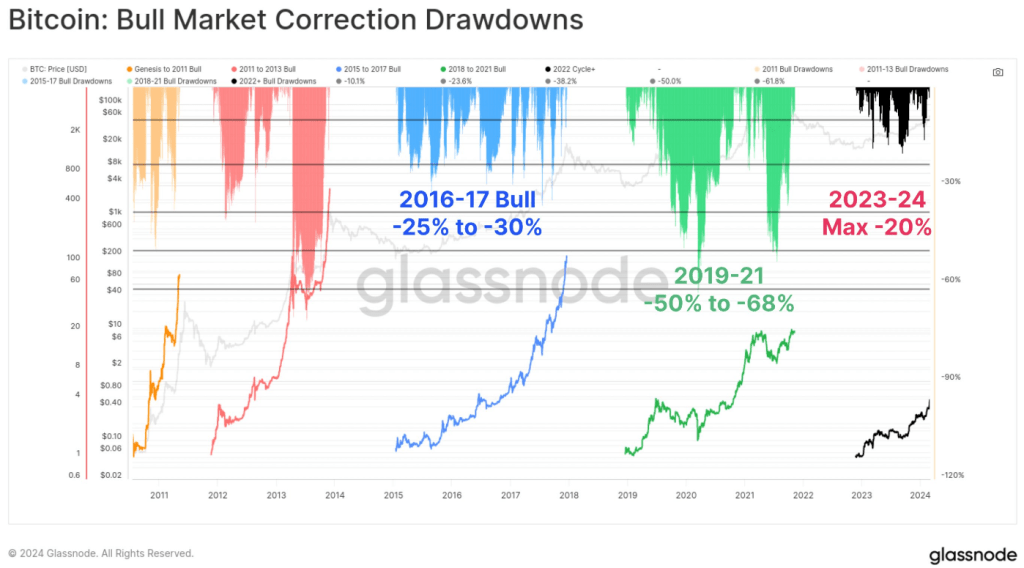

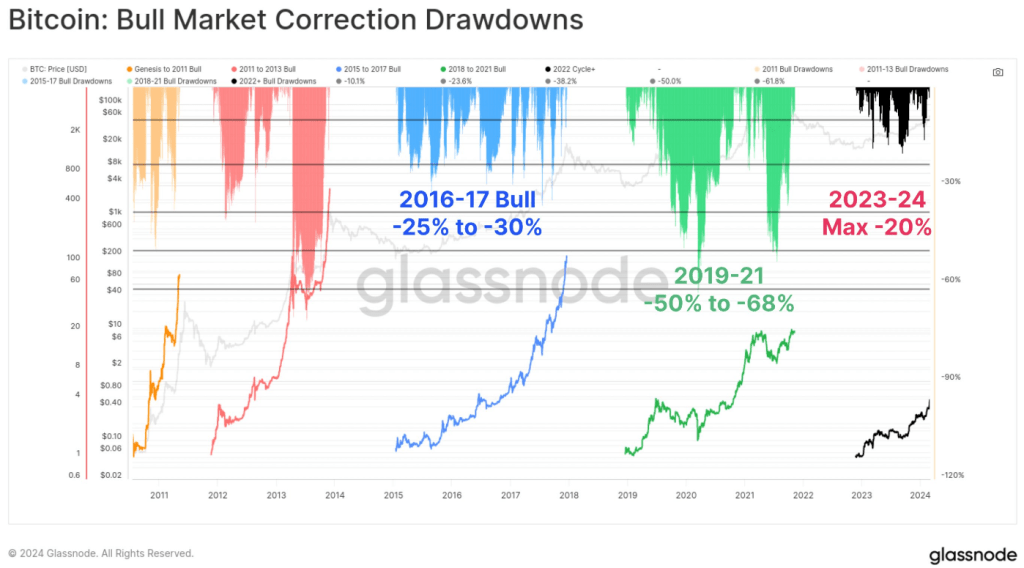

Nevertheless, prominent figures in the cryptocurrency space, such as Tuur Demeester, offer a more sanguine perspective. Demeester suggests that the recent dip to $60,000 might signal the floor of the correction, aligning with historical patterns observed during bull markets.

According to Demeester, a 20% drawdown from highs is considered a typical correction for Bitcoin, and thus, there is a strong possibility that $60,000 could serve as a support level moving forward.

BTCUSD trading at $65,883 on the 24-hour chart:

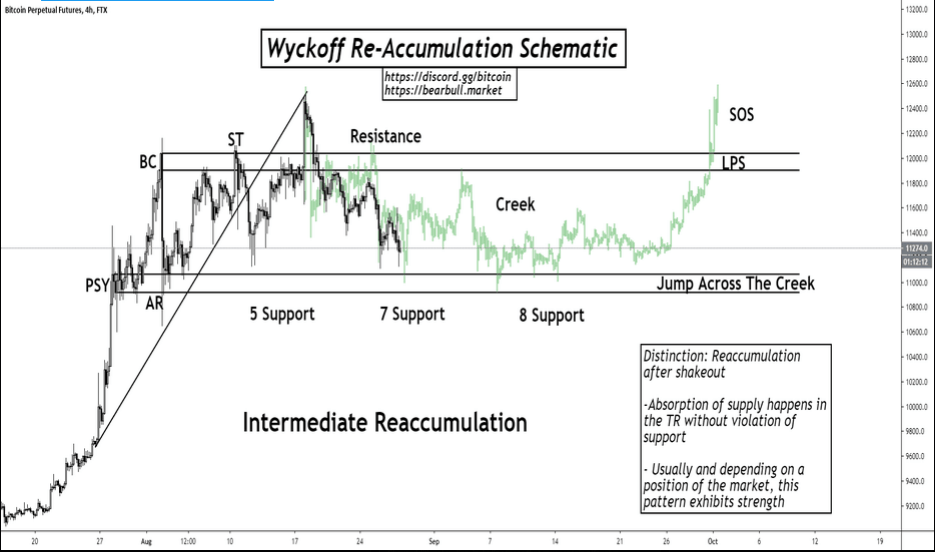

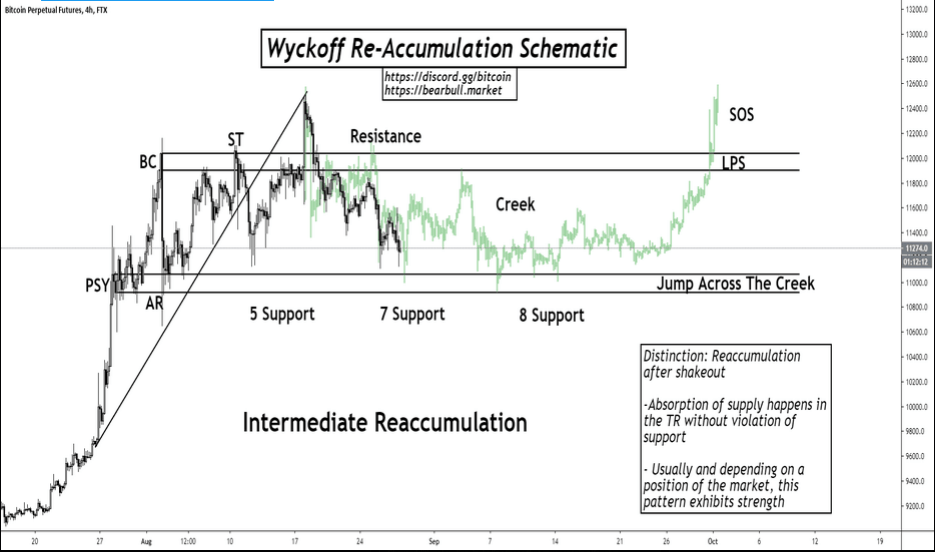

While Demeester advocates for stability in Bitcoin’s price, anoother analyst, McKenna, foresee a period of sideways movement. McKenna agrees with Demeester regarding the $60,000 floor but predicts that Bitcoin may enter a re-accumulation phase, characterized by prolonged sideways price action.

Interestingly, McKenna believes that this sideways movement could present an opportune moment for alternative cryptocurrencies, known as altcoins, to shine in the short term.

Related Reading

The recent resurgence in Bitcoin’s price has sparked optimism among investors and analysts alike. As attention turns to May, all eyes are on whether Bitcoin’s sideways movement materializes and if the effects of the halving event truly dissipate.

With cautious optimism prevailing, the current price range between $60,000 and $71,000 could become a pivotal zone for future price dynamics, ushering in a new era of prosperity in the cryptocurrency markets.

Featured image from Pxfuel, chart from TradingView