Ethereum And Tether Both Have Seen Withdrawals From Exchanges Recently

As explained by the on-chain analytics firm Santiment in a new on X, the market is ending July on a mixed note in terms of the exchange flows. The metric of interest here is the “Exchange Flow Balance,” which measures the net amount of a given asset that’s entering into or exiting the wallets associated with centralized exchanges.

When the value of this metric is positive, it means the inflows to these platforms are outweighing the outflows right now. Such a trend implies there is currently demand for trading away the asset among the investors.What implications either of these trends would have on the wider market depends on the exact type of cryptocurrency the one in question is: stablecoin or volatile asset. In the context of the current topic, Santiment has cited the data for Ethereum and Tether, which means both types of coins are relevant here.

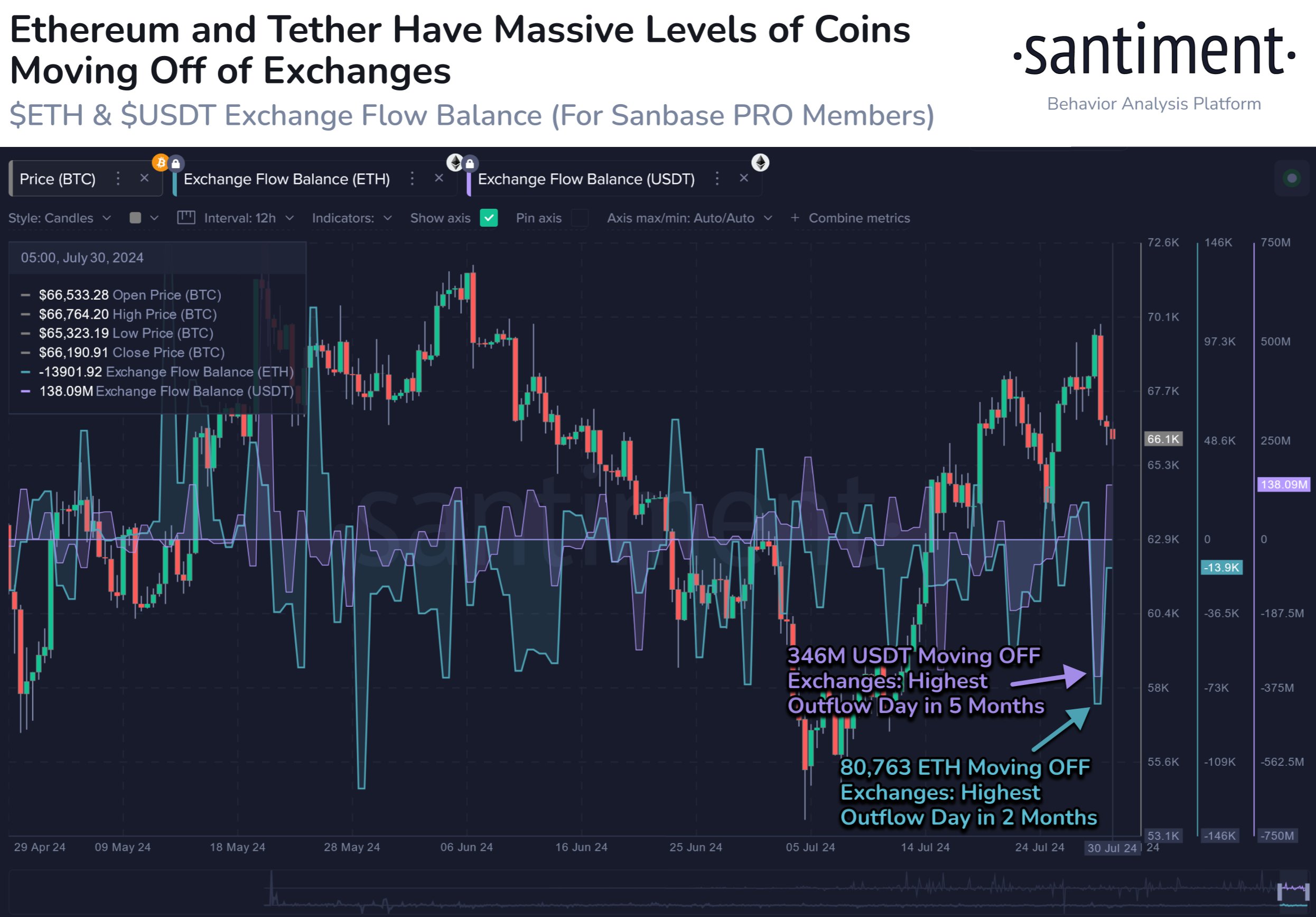

Below is the chart shared by the analytics firm that shows the trend in the Exchange Flow Balance for the two assets over the past few months:

As displayed in the above graph, the Exchange Flow Balance has recently observed a sharp negative spike for both Ethereum and Tether recently, implying that investors have been taking large amounts of these coins off into self-custody.

For volatile assets, trading the asset away can have a negative effect on its price, so the exchange reserve going up can be a bearish sign. The Exchange Flow Balance being negative, on the contrary, can be bullish, as it implies the potential “sell supply” of the coin is decreasing. During the latest outflow spree, investors have withdrawn 80,763 ETH (almost $268 million) from these platforms, which is the largest outflow spike in five months. Thus, Ethereum has seen its sell supply go through a significant decline.