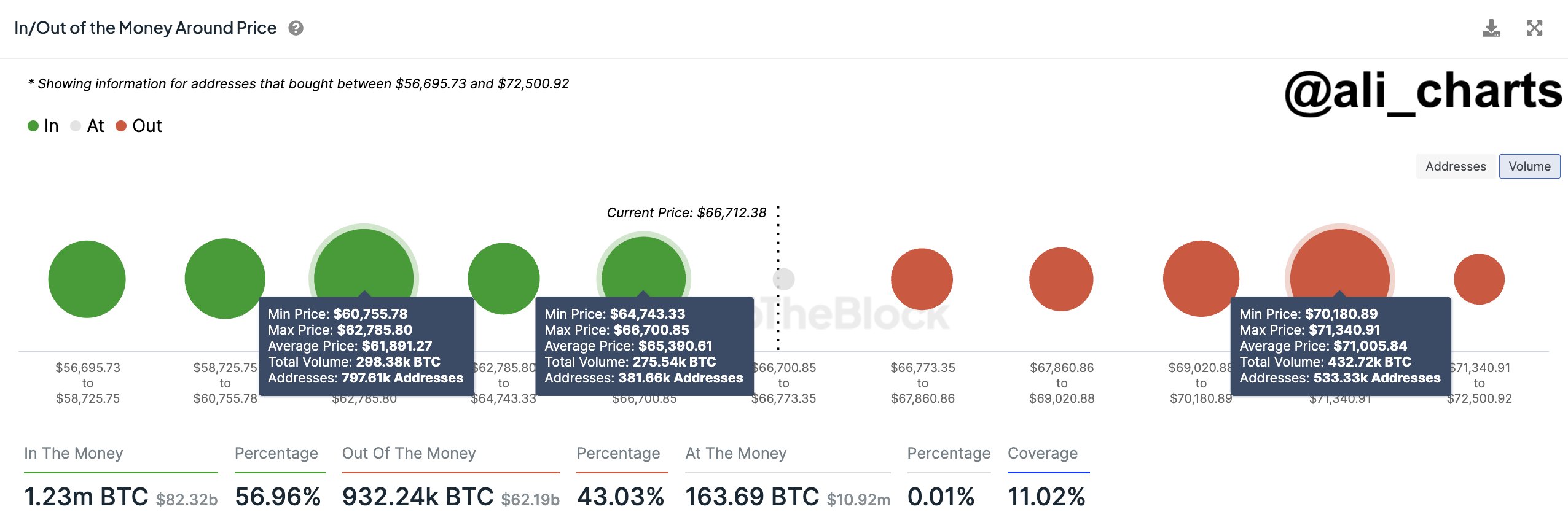

Over 500K Bitcoin Addresses Have A Cost Basis Between $70,180 & $71,340

As pointed out by analyst Ali in a on X, many investors have bought at the recently high price levels. Below is the chart shared by the analyst that shows how the distribution of the BTC supply looks right now across the various price ranges.How the BTC cost basis distribution looks like for the price ranges near the current one | Source:The data is from the market intelligence platform IntoTheBlock, which has used on-chain data to determine the average acquisition price for any given address based on when its coins moved into its balance. In the chart, the size of the dots represents the amount of coins that have their cost basis inside the corresponding range. It would appear that the $64,743 and $66,700 range is below the current price that hosts the cost basis of a significant amount of addresses.

More particularly, 382,000 addresses acquired 275,450 BTC at these levels. As the Bitcoin spot price is currently trading above this range, all these investors would naturally be carrying some profits.

The emerging reaction can be significant when many hands share their cost basis inside the same narrow range. If this retest occurs from above, the asset could feel some support as these investors rush to accumulate more.

Since the $64,743 to $66,700 range is dense with investors and is situated below the current spot price of the cryptocurrency, it could act as a major support center.This large block, however, may serve as a point of resistance for the cryptocurrency. These fresh hands might sell just as quickly as they bought in when a retest of their cost basis happens since they may be willing to just exit at their break-even, fearing more drops in the near future.

BTC Price

Bitcoin has seen a sharp correction during the past day, following which its spot price is now trading around the $67,900 level.BTC made a brief visit under the $66,000 level during this correction | Source: