Bitcoin Short-Term Holders Have Their Cost Basis At These Levels Ahead

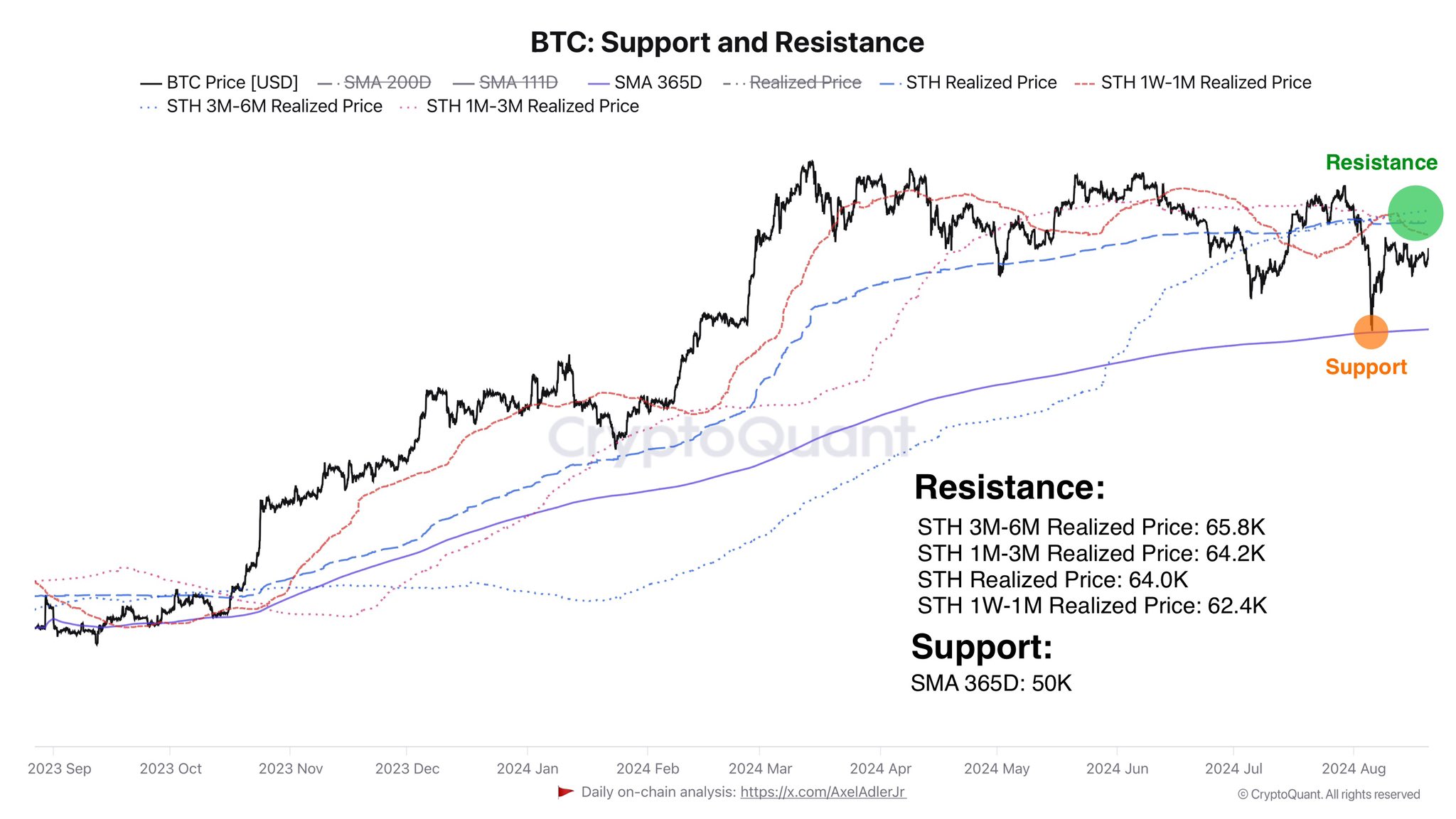

As explained by CryptoQuant author Axel Adler Jr in a new on X, the BTC short-term holders currently have their cost basis levels between $62,000 and $65,000. The on-chain relevance metric here is the “Realized Price,” which keeps track of the average acquisition price on the Bitcoin network.

When this indicator is above the cryptocurrency’s spot price, it means the average investor in the market is underwater right now. On the other hand, it being below BTC’s value suggests the dominance of profits on the network.In the context of the current topic, the Realized Price of the entire userbase isn’t of interest, but only that of a specific segment of it called the short-term holders (STHs). The STHs refer to the investors who bought their coins within the past six months.

This Bitcoin cohort has historically acted erratically, easily selling whenever a major change in the market has occurred, like the emergence of a rally or crash. Below is the chart shared by the analyst that shows the trend in the Realized Price of the STH group, as well as that of a few subdivisions of it, over the past year:

However, as the STHs are currently carrying a loss, they may be looking forward to the retest so they can sell and get their investment back. As such, Bitcoin could feel some resistance when it travels up to these Realized Price levels.