Global mkts slumping amid trade gloom. New tariffs were announced by both China & US. Trump cited his authority under IEEPA (trade war nuclear option) to order firms to cease doing business in China. Yuan sinks. US 10y ylds at 1.46%, lowest since 2016. Gold $1542, Bitcoin $10.3k. — Holger Zschaepitz (@Schuldensuehner)

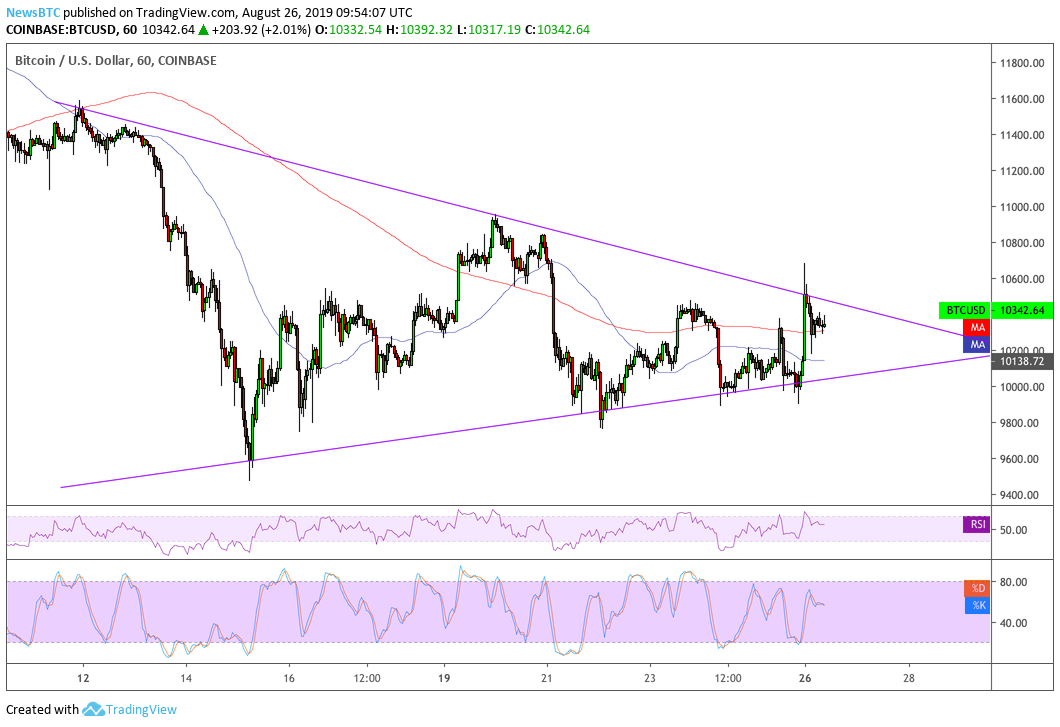

The BTC/USD instrument registered an intraday peak of $10,680 after surging close to 8 percent in just four hours. The shift in sentiment coincided with a bruising session in Asia, which saw investors fleeing from risky assets after taking cues from the US President Donald Trump’s comments over the weekend. He regretted his decision of not raising tariffs further than he had already.

Extended Sell-off Averted

Trump on Monday claimed that Beijing is looking to start a dialogue with Washington to end the trade dispute. Speaking at the sidelines of the ongoing G7 Summit in Paris, the president said China called their “top trade people” on Sunday night and requested to bring the peace talks back on the table.“I have great respect for the fact that China called — they want to make a deal. It is the first time I’ve seen them where they [really] do want to make a deal, and I think that’s a very positive step,” Trump said during a press meet.

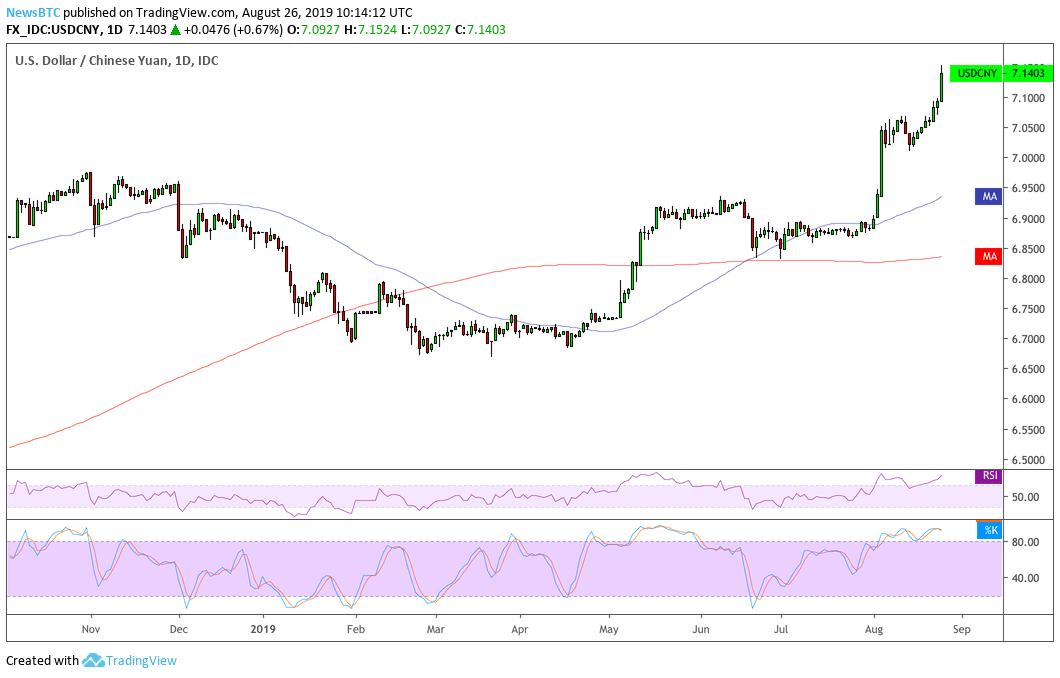

All Eyes on Renminbi

Gao Qi, a currency strategist at Scotiabank, said in a note that renminbi could shoot past its 11-year low levels should the US-China trade talks hit another dead end. He held the upside target towards the 7.2 level. Jason Saw, head of emerging markets at Société Générale, said that China could probably not act to put roadblocks before the renminbi’s depreciation.“Our view was that if the US kept imposing fresh rounds of tariffs it wouldn’t be inconceivable for the renminbi to reach 7.5 or higher,” he told . “This is starting to become a reality and could happen quickly if neither side backs down.”A weakening renminbi (or yuan) is historically bullish for bitcoin. Scott Melker of Texas West Capital weighs:

“If you are looking for narrative on the recent move, look at what just happened to the Chinese Yuan — absolutely getting crushed. Perhaps the Chinese are scooping up some Bitcoin as a store of value. It’s a fun thought.”