The legal battle between Ripple Labs and the US Securities and Exchange Commission (SEC) in the US District Court of Southern New York is still awaiting a ruling from Judge Analisa Torres. Just last week, Ripple CEO Brad Garlinghouse downgraded expectations, stating that a ruling would likely come in “two to six months” rather than the first half of 2023.

However, this is not stopping Ripple’s Chief Legal Officer (CLO) Stuart Alderoty from continuing to attack the SEC and expose its unlawful legal practices. Via Twitter, Alderoty a court decision over the weekend that shows just that.Ripple CLO Exposes Unlawful Guidance By SEC

Specifically, it concerns the “common enterprise” issue that is a component of the Howey test. The Ripple CLO writes that in the 1946 Supreme Court case “Howey”, the SEC unsuccessfully tried to pull off a trick that it is unpacking again today. At the time, the SEC wanted to enforce that an investment in a “common enterprise” was not required as long as there was a “common interest”.The SEC’s , where the “Framework for Investment Contract Analysis of Digital Assets” can be found, states that in order to satisfy the “common enterprise” aspect of the Howey test, federal courts require that there be either “horizontal commonality” or “vertical commonality” (Revak v. SEC Realty Corp.). The Commission, on the other hand, does not require vertical or horizontal commonality per se, nor does it consider a “common enterprise” to be a distinct element of the term “investment contract”.The SEC is so arrogant that it ignores the law and brags about it.

Whether Judge Torres will agree and rule in Ripple’s favour remains to be seen. The pressure on the judge is likely to be intense, especially in light of the US Democrats’ attack on crypto.The Revak case exposes yet another SEC sleight of hand. Without a ‘common enterprise’ it matters not whether ‘the fortunes of investors’ are tied to the efforts of others. The Howey test is not ‘so easily satisfied.’

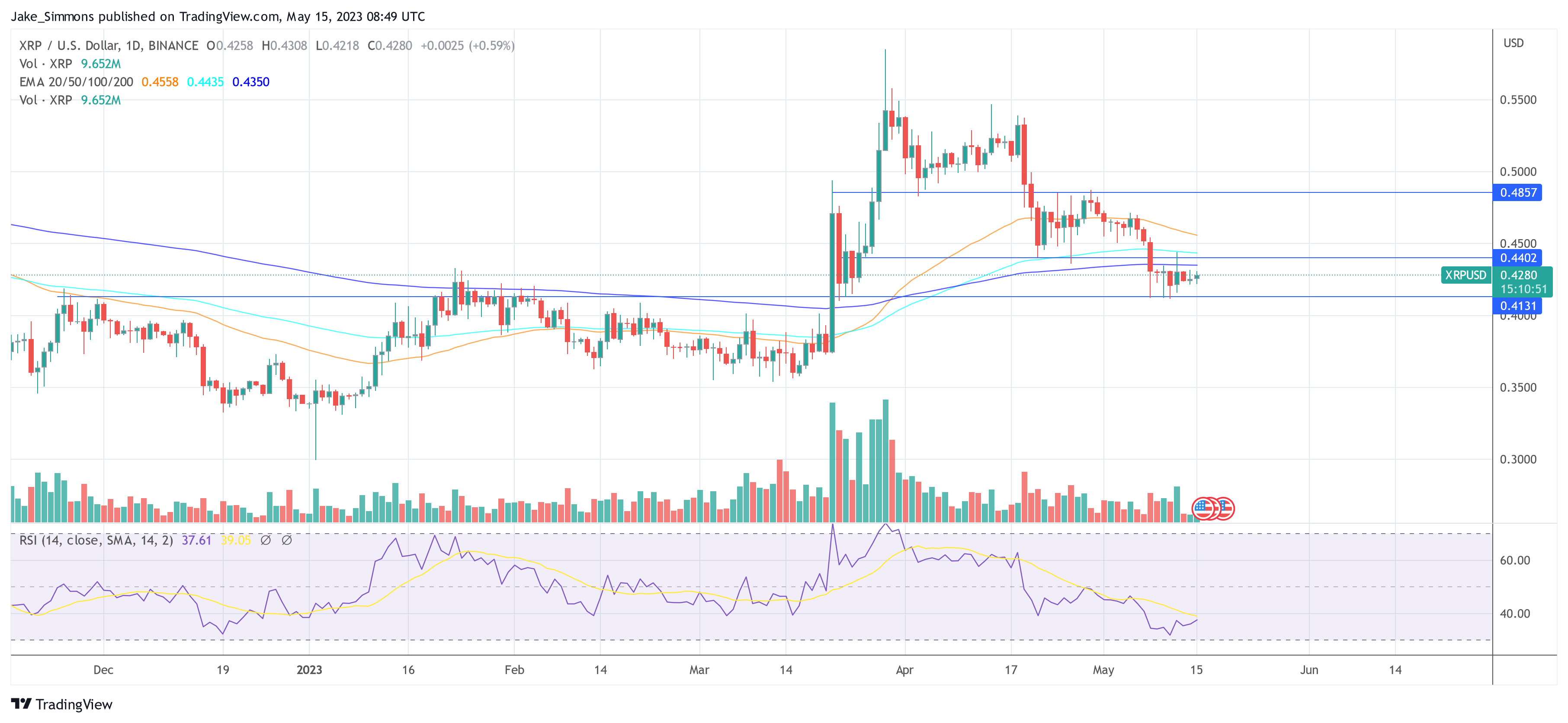

XRP Price Above Key Support

At press time, XRP was trading at $0.4280, holding above the key support level of $0.4131 over the past few days. This support is crucial as a break below it would send the XRP price back into the early November 2022 to mid-March 2023 trading range, a signal the bulls should avoid at all costs.