With Bitcoin consolidating for nearly six weeks and the cryptocurrency community expecting a major move as a result, open interest in BTC options has been surging across the market.

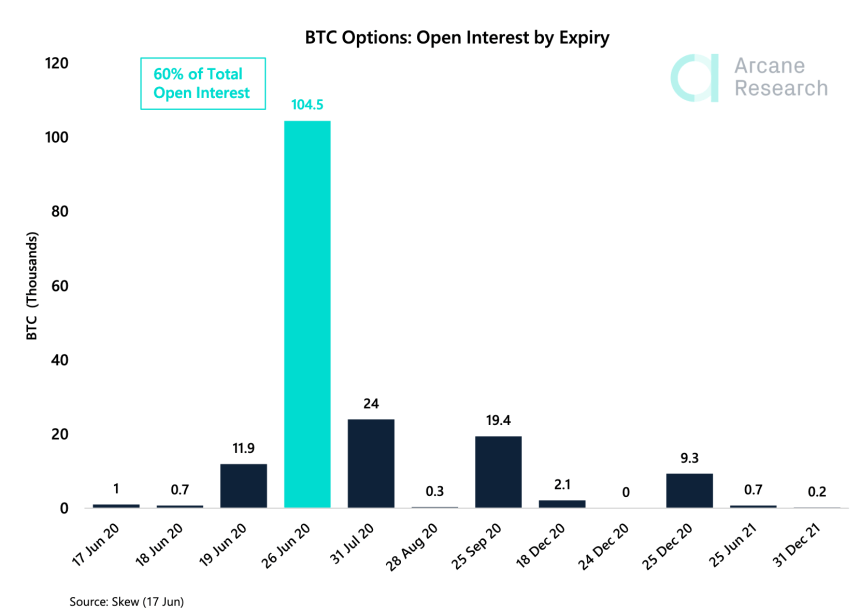

This coming Friday, June 26, nearly $1 billion in value worth of open interest in options, representing 60% of all options open interest, is set to expire. And when it does it could bring about a much need break in the sideways price action and a steep surge in the asset’s trademark volatility.

Bitcoin Trades Sideways For Weeks, Preparing For Move To $11K or $7K

Bitcoin price has been stuck in a tight trading range for a month and a half. Several attempts to breach above $10,000 have been made, but none thus far has managed to hold.

However, sellers have equally been unable to cause any sort of price weakness that brings the asset down to retest support below. A series of high lows has kept any uptrend intact.

Related Reading | This Volatility Measuring Tool Is Signaling One of Bitcoin’s Biggest Moves Yet

The lack of direction and clear trend has brought volatility to record lows, but a break is soon expected.

Data shows that when Bitcoin finally break out from consolation, expansion follows pushing the price by at least 20% or more.

20% to the upside would be a clear breakout of the bear market triangle at $11,250. Downside breakouts could target $7,500 or lower. But first, a break is necessary.

60% of BTC Options Expiring Could Light Crypto’s Short Fuse

Before the end of this week, the break in volatility may finally be here.

This coming Friday, June 26, over 60% of the open interest in . Although Bitcoin options are tiny compared to spot and futures in market share, such a large portion of contracts could prompt traders to try and influence spot prices to settle their options contracts in their favor.

Given the lack of volatility and how many traders that may be sidelined by the market choppiness, any significant price movements in either direction could be amplified due to a decision finally being made.

This past Friday, an ominous-sounding event called the “Quadruple Witching” occurred in the stock market. It got its name from an old wives’ tale related to “the witching hour” when witches and other spirits came out to cause a ruckus.

Related Reading | Data Shows Bitcoin More Likely To Pump Following Consolidation, 20% Move Anticipated

It’s also the name for when four types of stock options expire all at once, which can also cause a ruckus across the stock market.

The same could happen in for Bitcoin, with such a large sum of similar options contacts expiring all at once.

Any price movements may occur going into expiration, so this entire week could be a nail biter. The day, in particular, to watch for, however, is Friday, June 26, when contracts expire.