The Federal Reserve’s (Fed) decision to raise the Federal Funds Rate (FFR) by 25 basis points to 5.50%, the highest level since February 2021, had little impact on the cryptocurrency market and Bitcoin (BTC), with the event described as “” by the Journalist Ted Talks Macro.

The FOMC indicated that achieving its 2% inflation target still has a long way to go and that it will take a data-dependent approach to future rate hikes.

While some investors had been hoping for a more hawkish tone from the Fed, the central bank’s cautious approach was seen as a sign that it is still concerned about the potential impact of its monetary policy on the broader economy.

According to Ted, the full effect of tightening is yet to be felt, and getting back to the inflation target may require below-trend growth and labor market softening.

Despite the Fed’s decision to raise rates, they may raise them again in September, depending on the data.

The Fed’s decision to keep Quantitative Tightening (QT) unchanged was also a sign that the central bank is taking a measured approach to monetary policy.

The markets reacted positively to the Fed’s decision, with Bitcoin and US equities both higher. Many investors interpreted the event as a signal that the Fed is getting closer to hitting the pause button on rate hikes, which could be positive for risk assets in the near term.

Bitcoin Bulls Charge Forward As Sell Wall Disappears

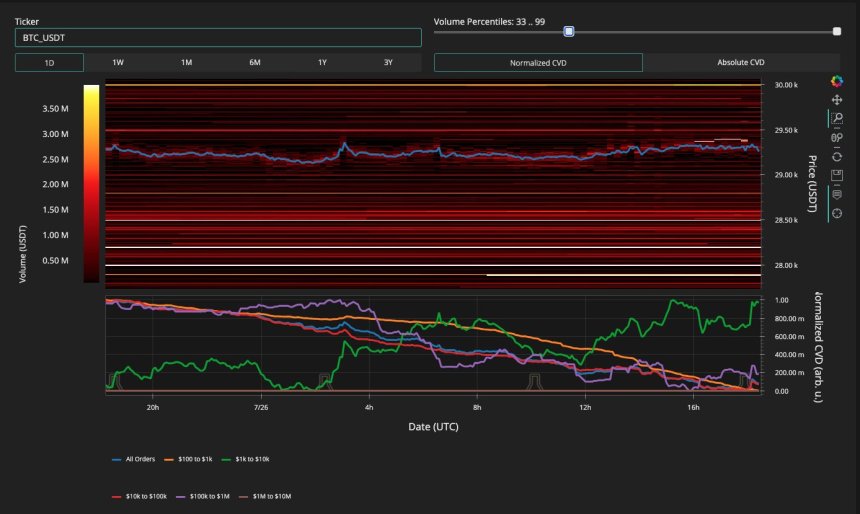

After the Federal Open Market Committee (FOMC) announced a 0.25% increase in interest rates, crypto market and data analysis firm Material Indicators has that a sell wall at the $29,400 level has vanished.

This level is just above Bitcoin’s current price, which currently stands at $29,300 as of writing.

According to Material Indicators Firechart, a significant level has cleared for Bitcoin, allowing the cryptocurrency to breach this zone and reclaim higher price levels. However, in the short term, Bitcoin’s 50-day Moving Average (MA) may present an obstacle, as it currently sits above the cryptocurrency’s current price.

Despite this challenge, there is good news for Bitcoin bulls, as the cryptocurrency’s Average Directional Index (ADX) has experienced a significant drop and is approaching the neutral level.

As seen in the 1-day chart below, this drop in ADX is often followed by a strong uptrend, potentially propelling Bitcoin back above the $30,000 mark. Moreover, Bitcoin may be able to trade above its 50-day MA and regain it as a support level, as it has been doing for the last month before its 5% decline last week.

These technical indicators suggest that Bitcoin may be poised for a rebound shortly, which could be welcome news for investors and traders alike.

Featured image from iStock, chart from TradingView.com