In-Depth Market Analysis Of The Bitcoin Market

The analysis begins with a detailed look at the market’s recent behavior, focusing on the aftermath of Bitcoin ETF launches. Edwards points out, “Two months of chop and ETF readings under the microscope appears to be resolving to the upside as of writing.”He highlights the significant shift in momentum following the initial “sell the news” reaction to the ETF launches, noting a considerable decrease in outflows from the Grayscale Bitcoin ETF. This change, according to Edwards, aligns with his previous predictions.

Furthermore, Edwards highlights the massive success of Blackrock and Fidelity’s Bitcoin ETFs (IBIT and FBTC), which have collectively absorbed over $6 billion in assets in less than a month. This achievement not only underscores the ETFs’ historic launch success but also signals a broader acceptance of Bitcoin within the traditional finance sector.

“Bitcoin [is] the most successful ETF launch in history by a very wide margin,” Edwards notes, referencing data from Eric Balchunas to emphasize the unprecedented scale of Bitcoin’s entry into the ETF market.Here's a look at the Top 25 ETFs by assets after 1 month on the market (out of 5,535 total launches in 30yrs). and in league of own w/ over $3b each and they still have two days to go. and also made list. — Eric Balchunas (@EricBalchunas)

Technical Outlook And BTC Price Prediction

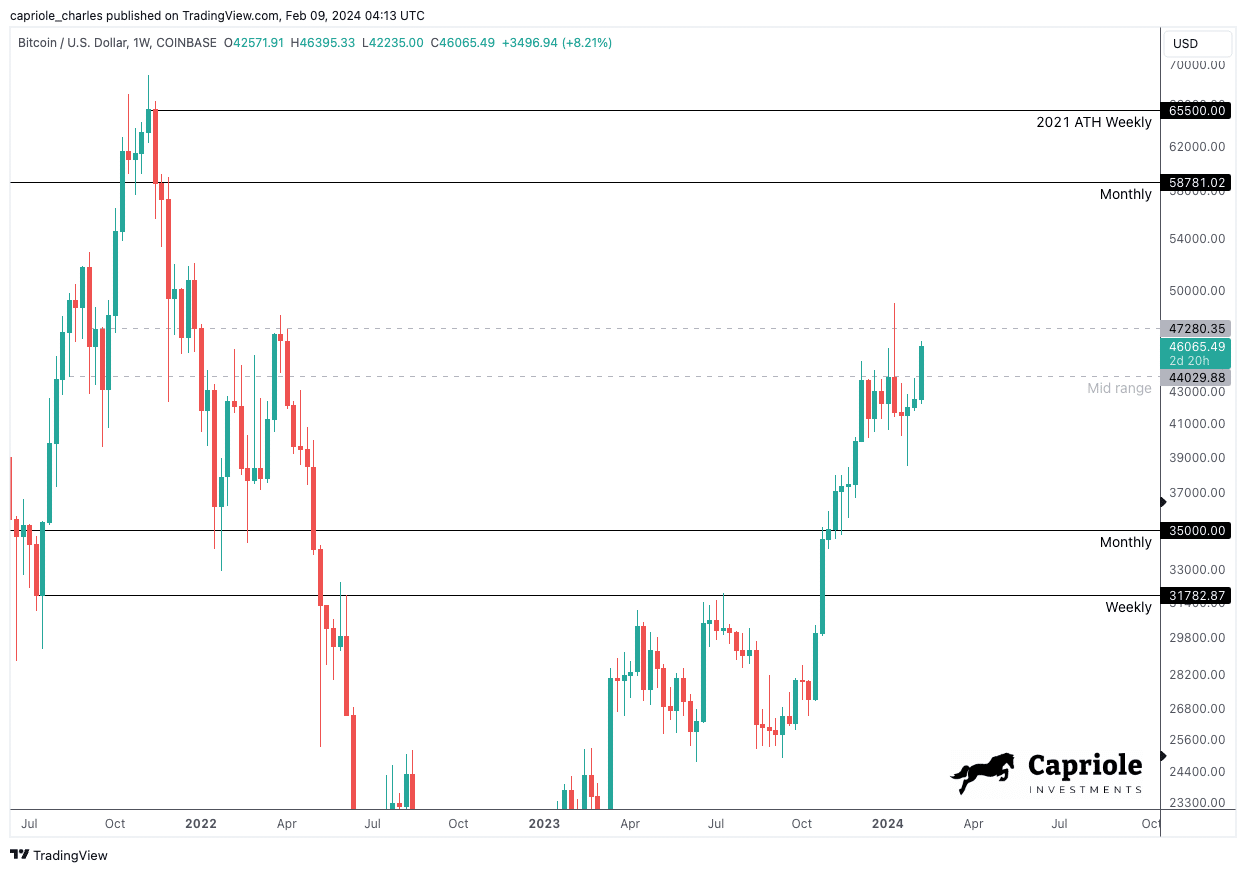

Turning to the technical analysis, Edwards points out the bullish trend that has taken shape, with Bitcoin breaking past the $44,000 resistance level. This breakout, according to Edwards, is a strong indicator of the market’s bullish sentiment and a precursor to further gains.

He notes, “The Weekly closing above $47K mid-range bound on Sunday would give a great technical confirmation of a new bullish trend,” highlighting the significance of this level as a determinant of the market’s direction.

Fundamentals Turn Bullish

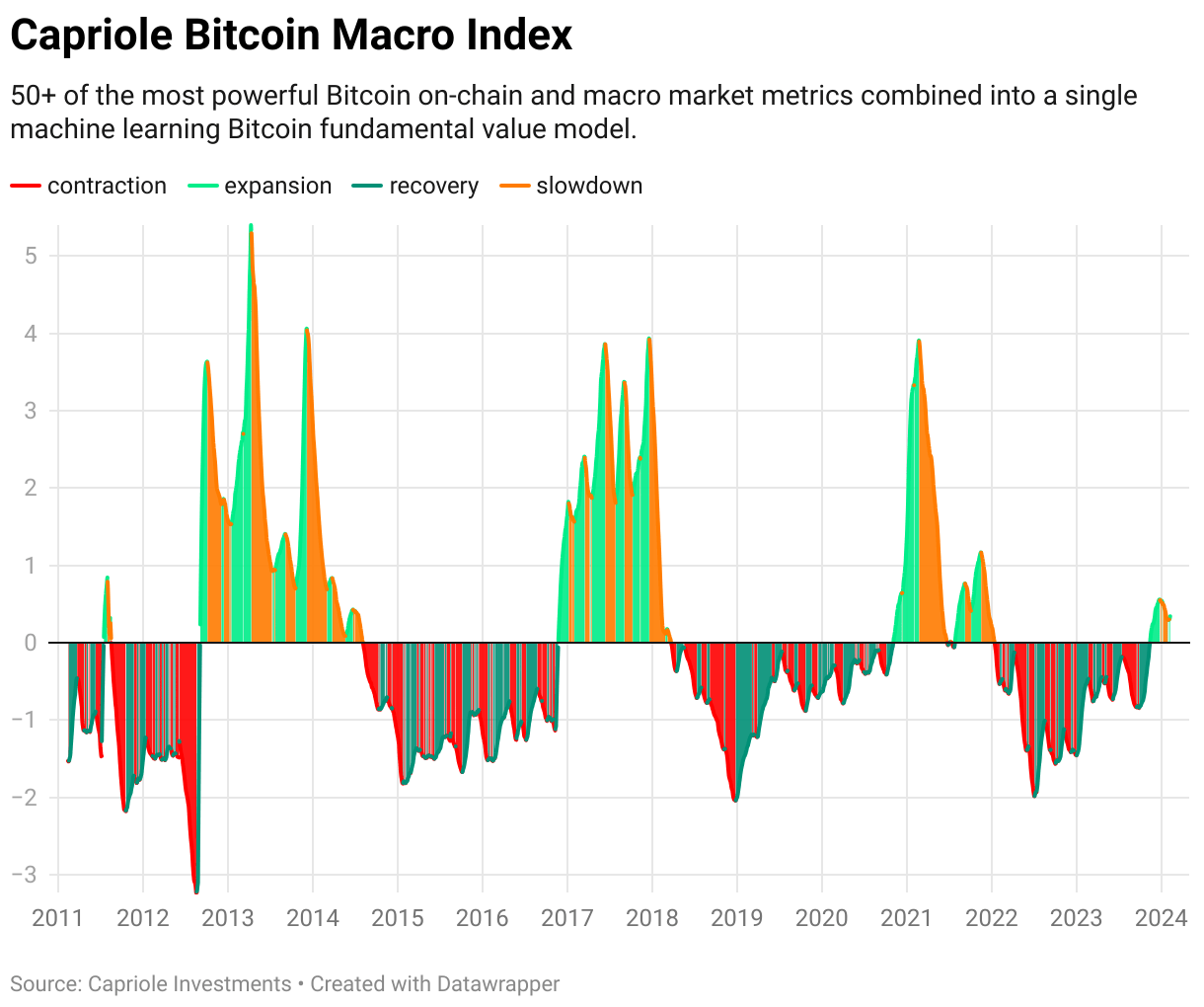

The foundation of Edwards’ bullish outlook is also built on a robust analysis of fundamentals and on-chain data. The Capriole’s Bitcoin Macro Index, which aggregates over 50 Bitcoin-related metrics into a single model, plays a crucial role in this analysis. “The fundamental uptrend resumed on Wednesday which is also supportive of continuation of the technical move. We want to see on-chain fundamental growth continue with price to support confirmation of this mid-range breakout. Monday’s reading will be particularly important,” Edwards states.