As Ethereum’s price approaches new all-time highs, the coin’s supply shock seems to be deepening with exchange reserves declining 18% in the last five months.

Ethereum Exchange Reserves Are Down 18% In The Last 5 Months

As pointed out by a CryptoQuant , ETH’s exchange reserves seem to have declined a lot in the last few months, signaling that a supply shock might be brewing in the crypto.

The all exchanges reserve is an indicator that shows the total amount of Ethereum present in wallets of all exchanges.

An increase in the metric’s value means investors are moving their coins to exchanges for selling purposes, thus increasing the available supply of the crypto. Such a trend could be bearish for ETH.

A decrease, on the other hand, would imply that holders are taking their Ethereum off to personal wallets, either for hodling them, or for selling through OTC deals. This trend can prove to be bullish for the crypto.

Related Reading | Bitcoin Attempts Fresh Increase, Why BTC Could Struggle Near $62K

Now, here is a chart that highlights the trend in the value of the indicator through this year:

ETH's exchange reserves seem to be on a constant decline | Source:

As the above graph shows, the indicator’s value has been showing a steady decrease since a while now. In the last five months alone, the reserve has dropped by 18%.

Related Reading | TA: Ethereum Outperforms Bitcoin, Why ETH Could Rally To New ATH

Incidentally, 5 months ago was around when the crypto broke above $4k for the first time. The exchange reserve measured around 22 million ETH back then. Since then, the coin has broke $4k two more times, and each time the reserve has been lesser. Today, the value of the indicator is just 18 million ETH.

This trend shows that the demand for Ethereum has been pretty different each time the coin has approached its ATH. Since the exchange reserves are very low right now, the usual supply and demand dynamics tell us such a supply shock may help propel the price of the coin up soon.

ETH Price

At the time of writing, Ethereum’s price floats around $4.4k, up 11% in the last seven days. Over the last month, the crypto has gained 54% in value.

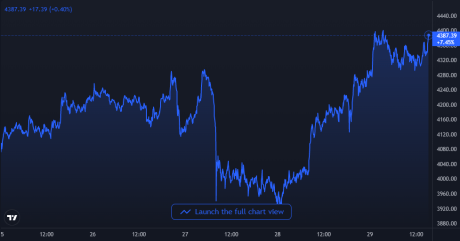

The below chart shows the trend in the price of ETH over the past five days.

Ethereum's price recovers from the crash and is now heading towards a new ATH | Source:

ETH has shown some volatility in the last few days as the coin’s price crashed to $3.9k a couple of days back, but has already recovered back higher. If the supply is anything to go by, the coin might be ready to head up soon and explore new ATHs.

Featured image from Unsplash.com, charts from CryptoQuant.com, TradingView.com