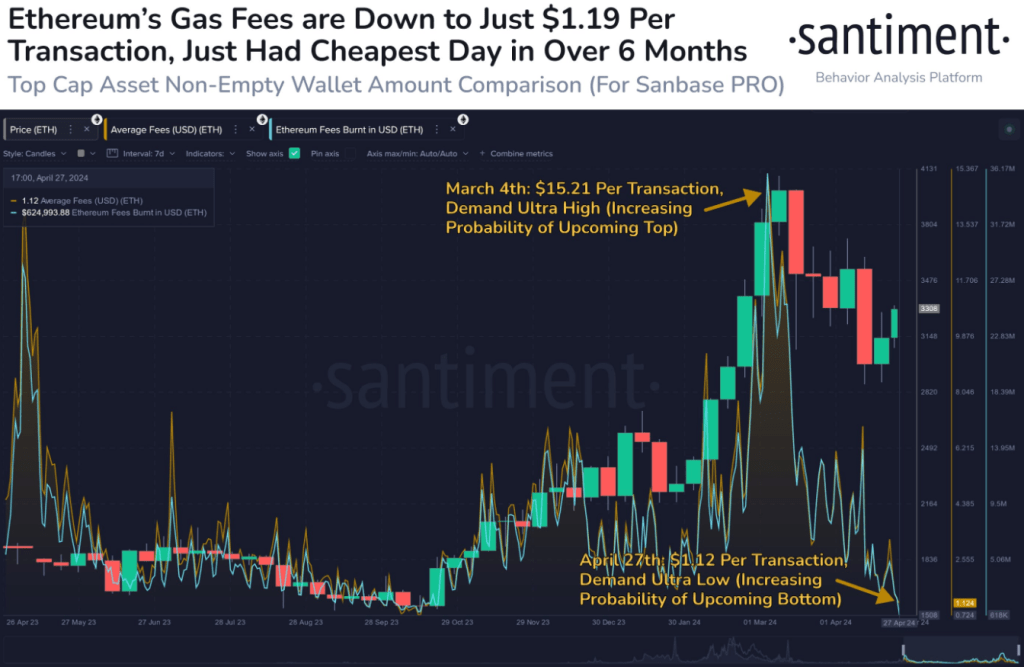

Based on a recent study by well-known crypto analytics tool Santiment, Ethereum, the second most valuable cryptocurrency by market capitalization, has seen a startling decline in transaction costs.

The report indicates that the average Ethereum transaction fee has plunged to a mere $1.12, marking the lowest daily average cost since October 18th, 2023.

Ethereum Transaction Fees: A Window Into Market Sentiment

Both experts and crypto enthusiasts have started debating this notable drop in transaction fees. According to Santiment’s research, the general attitude in the bitcoin market and transaction costs show a close relationship.

The analysis highlights that periods of exuberance, often characterized by the “to the moon” narrative and a belief in exponential price gains, tend to coincide with higher transaction fees. Conversely, during market downturns dominated by pessimism, transaction fees typically fall.

🤑 ‘s average fee level has dipped to just $1.12 per network transaction, the lowest average cost in a day since October 18th.

Traders historically move between sentimental cycles of feeling that is going “To the Moon” or feeling that “It Is Dead”, which can…

— Santiment (@santimentfeed)

Analysts claim that transaction fees provide an interesting window into the general attitude of the crypto market. Tracking these fees would help them to get important understanding of underlying demand patterns and investor confidence.

Lower Fees: Cause For Concern Or Optimism?

For investors, the low transaction fees of today create a rather puzzle. On the one hand, they could point to a decrease in network activity, therefore indicating a negative market attitude.

Santiment’s approach presents a more hopeful view, though. The paper suggests that the decreased fees together with the recent lessening of network difficulties should open the path for a better recovery for and other altcoins (alternative cryptocurrencies).

Ethereum is now trading at $3172. Chart:

Although the low costs could indicate less demand, researchers claim they also indicate a welcome decrease in network congestion. This might thus perhaps serve as a trigger for Ethereum’s price rebound, however it’s crucial to keep in mind that this could indicate a quicker turn around than many would have expected.

Investor Takeaway: Data Is King In The Cryptoverse

For even experienced investors, the always shifting terrain of the bitcoin market can be intimidating. With its data-driven approach and focus on sentiment indicator—transaction fees— Santiment provides insightful analysis for negotiating this erratic terrain.

The Road Ahead For Ethereum

Although the study presents a convincing view of the present state of affairs, it is important to keep in mind that the bitcoin market is complicated and shaped by several elements. It is yet unknown how these low transaction fees might affect things long term.

Featured image from Pexels, chart from TradingView