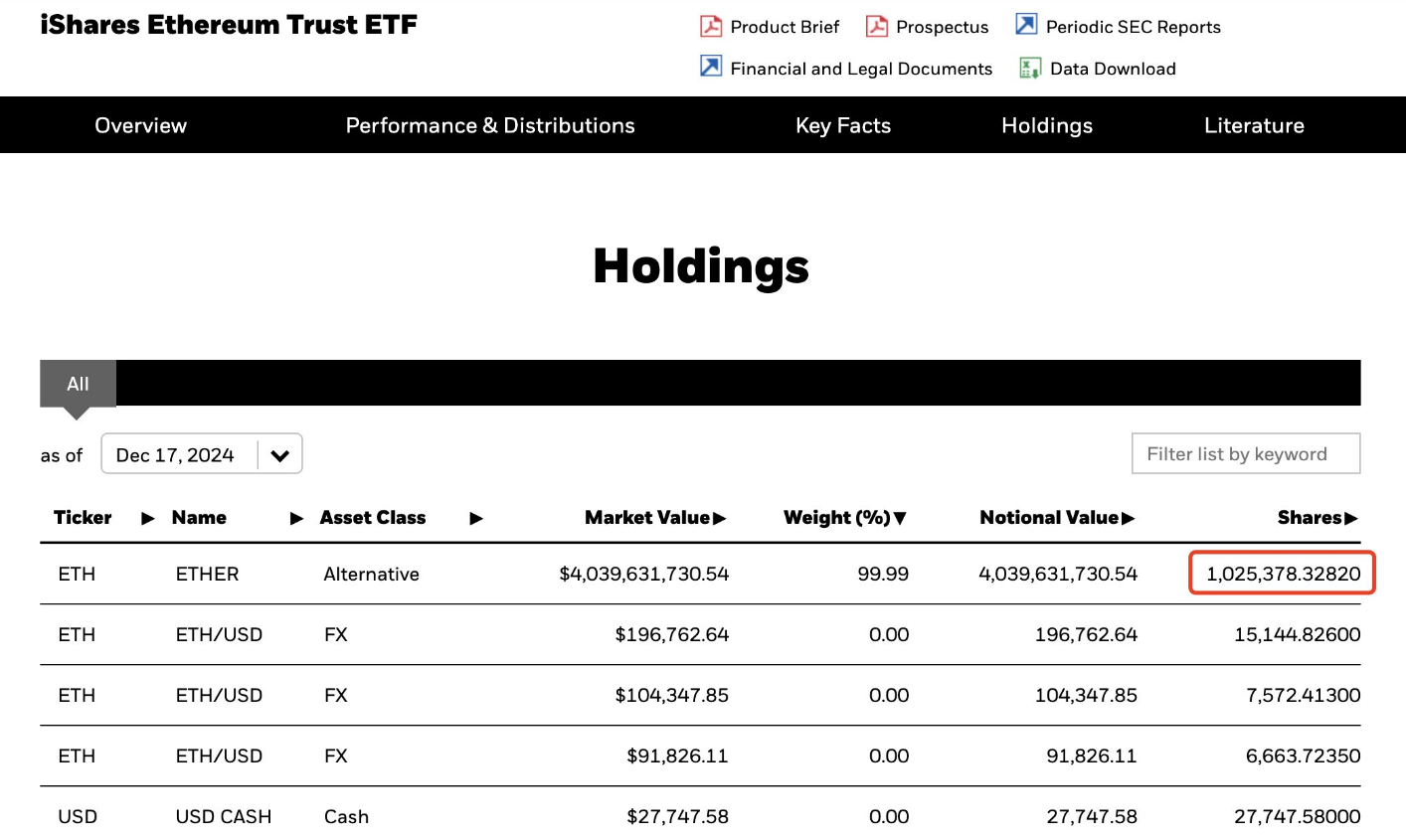

BlackRock’s iShares Ethereum Trust ETF (ETHA) has reached 1 million ETH in holdings, worth more than $4 billion. This milestone, attained on December 18, 2024, is a remarkable feat for the fund, which was founded only six months earlier in July.

As institutional interest in cryptocurrencies grows, this ETF emerges as a frontrunner among newly released products.

Institutional Interest On The Rise

BlackRock’s growing in Ethereum ETFs are part of a bigger trend of big companies investing in cryptocurrencies. In 2024, billions of dollars were invested in new Bitcoin and Ethereum exchange-traded funds.

According to blockchain tracker Lookonchain, ETHA now has 1,025,378 ETH, making it the first new Ethereum ETF to reach this milestone. In comparison, Grayscale’s Ethereum ETF contains approximately 476,000 ETH.

BREAKING: ’s iShares Ethereum Trust ETF now holds over 1M , totaling 1,025,378 ($4.04B).

— Lookonchain (@lookonchain)

The increase in assets under management (AUM) is especially impressive given the initial difficulties experienced by at launch. Many products experienced minimal inflows as they competed with larger funds such as Grayscale’s ETHE.

Beginning in September 2024, a substantial shift has occurred. Subsequent to political events like Donald Trump’s electoral triumph, market sentiment has significantly enhanced. Reports indicate that net inflows to Ether ETFs surpassed $850 million in the previous week.

A Promising Future For Ethereum

Experts feel that rising interest may indicate a bright future for Ethereum. Juan Leon, a senior investment strategist at Bitwise Asset Management, believes Ether is due to rebound in 2025. He says that the market for real-world assets may produce more than $100 billion in annual fees for ETH, much beyond its current earnings.

The current influx of capital into Ethereum ETFs reflects institutional investors’ newfound confidence. CoinGlass data shows that these products have recently received significant investments, with total assets across several Ethereum ETFs topping $14 billion. This trend shows that more investors want to obtain exposure to Ether without the hassle of managing their own wallets.

Looking Ahead

The Head of Digital Assets Research at BlackRock warns that it might take some time for Ethereum products to catch up to their Bitcoin counterparts, despite this encouraging trend. As the market and regulatory environment changes, the path ahead can still be difficult.

Nevertheless, with growing institutional support and increasing interest from traditional finance entities, the outlook for BlackRock’s Ether ETF and the broader cryptocurrency market appears promising as we move into 2025.

Featured image from DALL-E, chart from TradingView