, a UK-based digital banking corporation and a strong supporter of Bitcoin and the distributed ledger technology has secured a US$70 million funding round to penetrate the UK banking market.

The organization, led by a group of experienced veterans in the finance sector including former Allied Irish Banks CEO Anne Boden, former Head of Technology for Barclays Mark Hipperson, and former Divisional Risk Officer at Lloyds Banking Group Tony Ellingham attempts to use advanced and innovative financial technologies to enable real-time intelligence, intuitive money management, and most importantly, a PSD2 implemented payment network.

According to Starling Bank CEO Anne Boden, the bank is set to release credit and debit card networks which will allow its clients to settle transactions directly with another party, without the involvement of a third party application or a mediator with the exception of the bank.

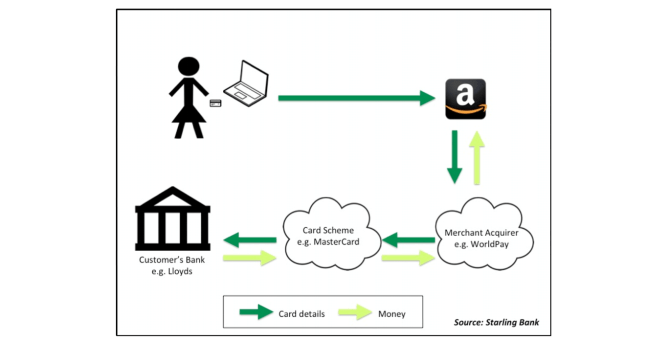

For example, when a traditional bank or financial platform user deals with an e-commerce platform such as Amazon, the financial data and credit information is passed onto Amazon, who then stores it and contacts the customer’s card scheme, like MasterCard or Visa who will pull the payment and debit the customer’s bank account.

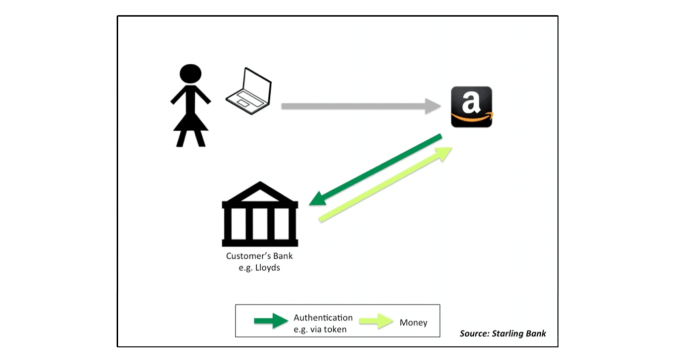

However, in a PSD2 implemented network which Starling aims to provide, clients will be able to pass their information directly to their own banks, without going through any intermediaries such as Amazon, Worldpay, and First data.

“Now fast forward to when PSD2 has been implemented. You are shopping again on Amazon, but instead of entering your debit or credit card details, you are asked whether you want to give the retailer access to your bank account, again at Lloyds. You agree and it takes you to the Lloyds internet banking site where you give your permission. This is similar to the way you allow applications to access your Facebook or Twitter account today. You do not give your bank login details to Amazon, or vice versa the retailer your logon details to your bank account, you simply give permission to Amazon to execute payments on your behalf via your Lloyds bank account,”

With the financial help of Harald McPike, the founder of Bahamas-based quantitative investment manager QuantRes, who led the funding round, Boden and her team aims to work with McPike and benefit from his background in algorithmic trading, risk management and technology to target a potential opening in the banking industry.

“It was important to us to have an investor with not just the financial strength but who also shared our ambition of empowering people with meaningful insight into their own financial information. With his background in algorithmic trading, risk management and technology, Harald sees the significant potential of technology in the retail banking sector. His commitment of US$70m is the catalyst needed to propel Starling’s launch,” .

“Our aim is clear — to bring about a revolution in retail banking, by developing an account architecture, using the latest available technology, designed to meet the needs of the modern customer,” Boden added.