While the crypto market has been bleeding out, Axie Infinity (AXS) records a 112% rally over the past week and a 14.7% profit in the daily chart. Bears are in disbelief, as this Non-Fungible Token (NFT) based platform continue to gain popularity, users, and moving to the upside.

As NewsBTC previously reported, Axie Infinity was inspired by Pokemon and allows its users to capture, breed, train, and battle with pet creatures called Axies to receive rewards. These creatures are tokenized on the platform in the form of NFTs and can traded with other players on a marketplace.

One of Axie Infinity’s most important features is that it allows players to turn their in-game assets into Ethereum (ETH). Thus, they can be taken out of the platform and turn into real word assets. This could give a new boost to what some are referring to as the “Gig Economy”.

P2E has created the 2.0 Guild, revenue-generating organizations that buy, breed, lease assets, and provide employment, in addition to community. They can solve the cold start challenge for new NFT games, and also become dominant net new asset buyers (Eg Axies).

Axie Infinity And The Transformation Of The Gig Economy

Players make a choice when they decide to spend their time on a certain game. So far, that choice has been limited to which game to dedicate time. Wu argues that in the future, the fundamentals of that decision will change to the point where players will decide to work for a company or play for a fix income.There are tens / hundreds of millions of people who would play a game for 6 hrs / day and make $500 / mo. And before, many did in the grey market, farming gold and other activities. The P2E economy has legitimized and operationalized this gig economy.

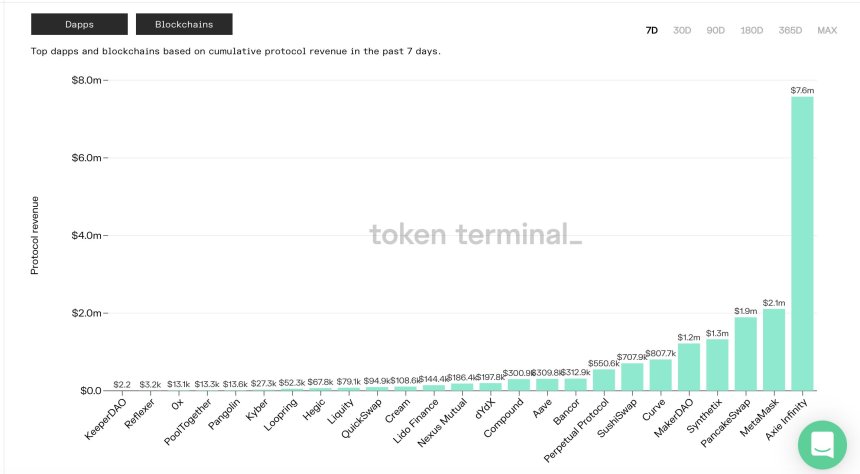

At the start of July 2021, Axie was generating more revenue than some of the biggest protocols in the DeFi sector, such as Synthetix, MakerDAO, Curve, and other, combined, according to data by his co-founder Jeffrey “Jihoz” Zirlin.