Related Reading | Coinbase Removes USD Coin (USDC)” Backed By Dollar” Statement

Other Cryptocurrency Assets Reacting To The New Market Trend

In the recent recovery trend in the industry, prominent digital assets such as Bitcoin (BTC) and Ether (ETH) are not left out. As a result, these cryptocurrencies have explored their mid-May market cap levels again. As of Monday, Bitcoin records a market value of over $860 billion. CoinGecko reveals that it’s the first time since May 16 for BTC to hit such a limit. The cryptocurrency experienced a main sell-off earlier in the year. This was after Bitcoin became a $1 trillion asset.Similarly, the global second-largest digital asset by market cap, Ether, is not left out. The cryptocurrency accrued more gains in July since the bear market. The asset had almost an 81% increase from its July 20th value of $204 billion to $369 billion.

After an incredible last week, the crypto market has taken a slight dip |On Thursday, the digital asset passed through a prominent network upgrade. The Ether price moved by 50% in response to the London hard fork. This displays investors’ anticipation of getting solutions to Ethereum’s high transaction fees through the upgrade. Though the crypto market experienced a recent positive turning, some key cryptocurrencies somersaulted in their market cap value. For instance, Binance USD (BUSD), a top-ranking stablecoin by market value after Tether (USDT) and USD Coin (USDC), had a drop.

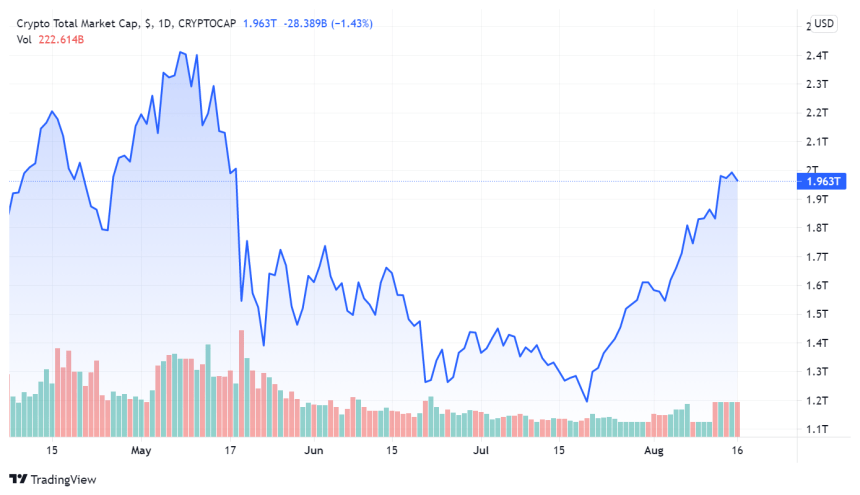

Total cryptocurrency market cap 90-day chartAs listed on Thursday, BUSD couldn’t make it among the top 10 most-valued digital assets. UNI, Uniswap’s governance token, dethroned BUSD from the list. This left BUSD as the 11th-largest cryptocurrency with a market cap of $12 billion.

Related Reading | Lionel Messi To Get Paid In Crypto For Joining Paris Saint Germain

Recall that this recent growth trend in crypto market value occurs after Elon Musk, the CEO of Tesla, revealed debt to Bitcoin. Musk mentioned on July 22 that SpaceX, his aerospace firm, is indebted to Bitcoin. Furthermore, he announced Tesla’s plan to recommence its acceptance of crypto payments for purchases. Musk explains that this decision was due to the remarkable drop in the percentage of fossil fuel used for Bitcoin mining. It alleged that the previous decision of the CEO in suspending BTC payment to his company was the main contributory factor to the May Bitcoin’s price crash.Featured image from Pixabay, chart from TradingView.com