Bitcoin has fallen below $35,000, and while given the asset’s recent highs sounds like a sizable correction, the price per BTC is still nearly 1000% higher than where it was less than one year ago. After such extreme moves to the upside, often come crashes that eliminate much of the progress made, until the parabola starts all over again.

Career trader Peter Brandt has shared a chart that subtly hints that the recent Bitcoin price parabola could begin to break down. The last time he did so, he accurately called an 80% decline in price. Here’s a look at what might come next if that’s the case.

Paying Attention To Peter Brandt Costs Nothing, Pays Out In Profits

Peter Brandt is a living legend, commodities, stocks, and more recently, cryptocurrency. Brandt has long been interested in Bitcoin, has shared his commentary about the market and related price action via his Twitter, and has contributed to the Bitcoin.Live platform.

Because of Brandt’s reputation and experience level, when he speaks, it tends to be worth paying attention to. Those who wisely took profit during the last major Bitcoin rally after the trader claimed the parabola was violated, would have even been given almost the exact target to which the cryptocurrency fell to nearly a year later.

Related Reading | Proper Altcoin Season While Bitcoin Drops Has Traders “Cautious”

The trader famously called for an 80% or more retrace following the 2017 peak of $20,000. In 2018, Bitcoin traded at $3,200. Brandt nailed it, and now he’s back at it again.

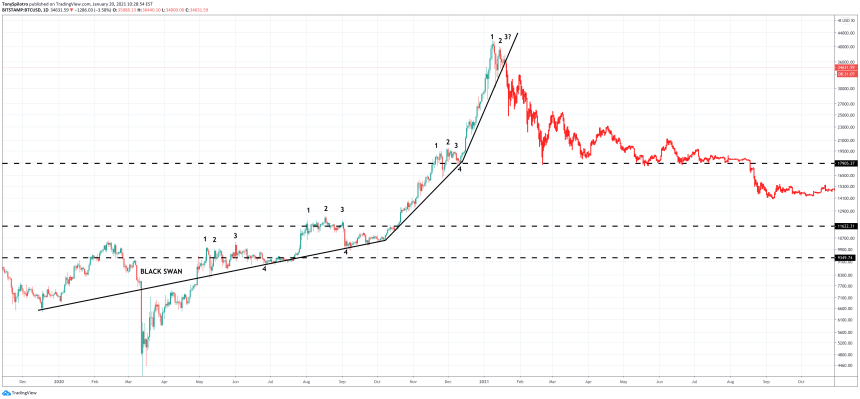

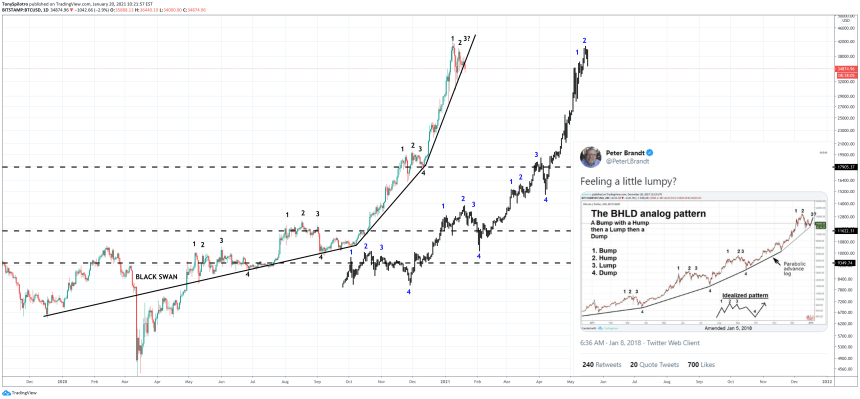

Peter Brandt calls attention to the current rally resembling this previous parabola breakdown | Source:

Brandt Brings Up Painful Reminder Of Past Bitcoin Parabola Broken

exhibiting a Bitcoin parabolic curve, just before the bear market took hold.

In the image, originally shared on January 8, 2018, a “bump, hump, lump, and dump” repeating pattern shows each parabolic base, just before the breakdown and resulting downtrend that follows. The chart above compares the rally Brandt references alongside the current parabolic rally.

Related Reading | The Striking Similarities Between The 2017 Bitcoin Peak And Now

Price patterns and even ranges appear to line up eerily accurately, with the primary discrepancy being the Black Thursday pandemic-driven panic selloff. Aside from that, the similarities are striking.

Repeating price patterns like this are called fractals. If what follows this near flawless fractal is also similar, the chart below would demonstrate what comes next.

Here's what happened after the parabola breakdown | Source:

Remember, Brandt called for an 80% correction of the parabolic move, and was correct. And while he hasn’t brought up that dangerous data point since back then, even the short-lived parabolic phase in 2019 ultimately corrected over 70%.

However, any downside is contingent upon the current parabola breaking down, and the new “hump, slump, pump, and dump” pattern failing to repeat.

Featured image from Deposit Photos, Charts from TradingView.com

Peter Brandt calls attention to the current rally resembling this previous parabola breakdown | Source:

Peter Brandt calls attention to the current rally resembling this previous parabola breakdown | Source: