Bitcoin Observes Largest Profit To Loss Transaction Ratio In 2 Years

As per data from the on-chain analytics firm , yesterday was the largest profit-taking day for BTC since February 2021. The relevant indicator here is the “ratio of on-chain transaction volume in profit to loss,” which, as its name already implies, measures the ratio between the daily volume being involved in profit-taking transactions and that involved in loss-taking ones.

The indicator works by looking through the on-chain history of each coin in the circulating supply to see what price it was last moved at. If this previous price for any coin was less than the current value of Bitcoin, then that coin is said to be holding a profit. Now, if the coin is sold while in this state, its sale transaction would contribute towards the profit volume.The value of the metric seems to have been quite high in recent days | Source:As shown in the above graph, the ratio between profit and loss transactions for Bitcoin was at a very high level during the past day. In this spike, there were more than 2.4 times as many profit-realizing transfers happening on the blockchain as compared to the loss-taking ones. This level of profit-taking is the highest observed since February 2021, around two years ago.

Interestingly, the latest surge in the metric coincided with BTC hitting a high of $23,900 yesterday. Since then, however, BTC has sharply declined and is now below the $23,000 level. This would suggest that it might have been these profit-taking transactions that have led to the latest pullback in the price of the cryptocurrency.

BTC Price

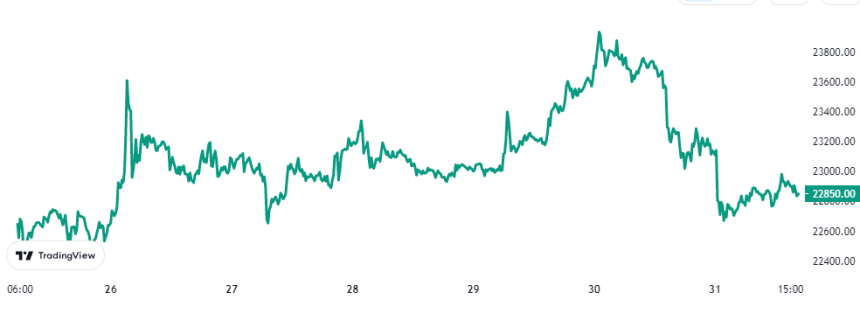

At the time of writing, Bitcoin is trading around $22,800, down 1% in the last week.

Looks like the value of the asset has taken a hit during the past day or so | Source: