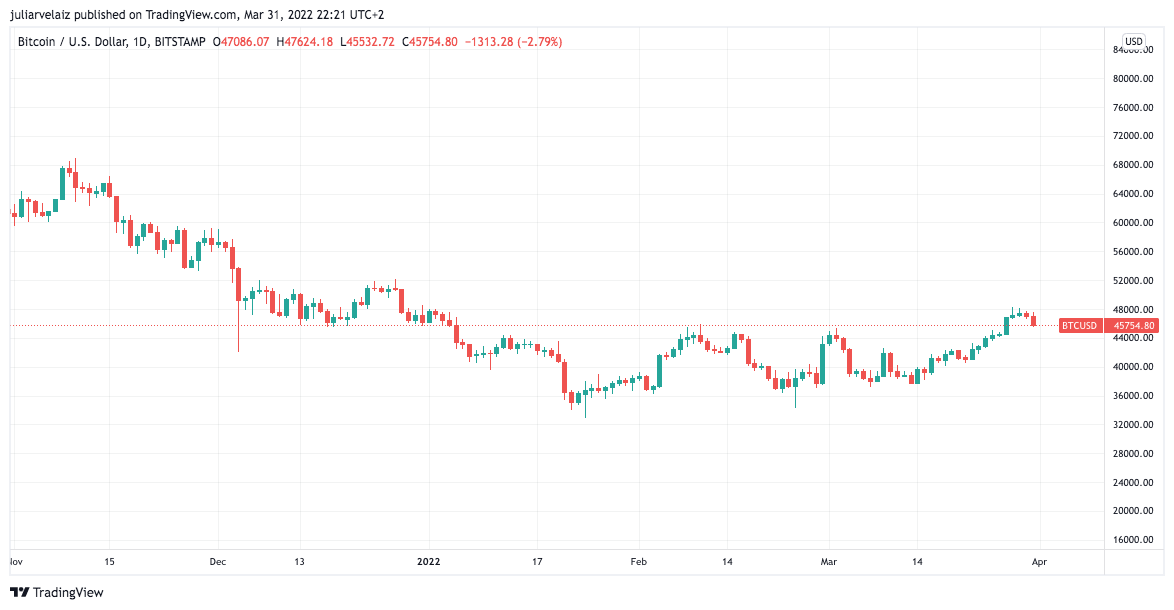

After bitcoin broke above the $45k resistance level reaching the $48k mark, it has retested the $45k level. Some analysts still expect a rise to above $50k, others have abandoned their bullish approach. Meanwhile, leading CEOs from Pantera Capital and Skybridge Capital remain positive that the coin will reach the $100k mark in a period of one to two years.

Pantera Capital CEO Is ‘Wildly Bullish’

In an with Yahoo Finance, the CEO of Pantera Capital Dan Morehead commented on Bitcoin’s price action so far in the year. Morehead noted that within the history of Bitcoin cycles, it’s had six previous bear markets that average about 60%, and 2022’s has been 50%.

In his opinion, the bitcoin cycles will begin to moderate thanks to large institutional engagement, and “a 50% bear market is probably all you’re going to get going forward.”

“I think we’re either at the lows or very close to it.”

Morehead said he is “wildly bullish right now” because he believes that Bitcoin and the asset classes will decouple, noting that the high correlation that usually happens during periods of stress –similar to 2022’s turmoil– eventually breaks, usually after a 72-days average. “I think stocks and bonds may keep going down potentially for years, whereas blockchain assets can go up.“

Morehead accepted that Pantera Capital failed to predict how fear over the Fed’s rates rising would affect the crypto market, but believes that “in this case, the markets have it wrong, and blockchain will decouple from the other asset classes.”

“If you think about it, with rates rising, that is mathematically negative for bonds. It also has a negative impact for anything else with discounted cash flows like equities or real estate, but blockchain’s totally independent of rates.”

In his forecast, Morehead expects that six months from now bitcoin will be back to the typical 2.5X yearly growth that it’s been doing for 11 years. If so, then in a year Bitcoin could be worth about $100,000 per coin.

Scaramucci Sees a $500k Bitcoin

Similarly, in an with CNBC, the CEO of Skybridge Capital Anthony Scaramucchi predicted again that “Bitcoin will hit $100k in the next two years” based on adoption growth.

Scaramucchi quotes Glassnode claiming that “there’s probably 245 million wallets out there or accounts related to Bitcoin,” while in October-November of 2020 there were about 85 million wallets. The CEO believes the growing adoption turns into people being more confident in the coin.

“Somebody like Cathie Wood would say to you, a billion wallets, Bitcoin could easily trade to $500,000 a coin.”

While Scaramucchi’s predictions from 2021 were not spot on, he accepts that he failed to anticipate the Russo-Ukrainian war and the elongation of COVID, but he sees no reason for Bitcoin not to hit the $100K mark within two years “given the way it’s scaling globally” and its many use cases.

Related Reading | Will Strike Announce A Partnership With Apple At Bitcoin 2022? Here’s The 411

A Bullish Pattern

Meanwhile, analyst Yuriy Bishko that BTC follows a Wyckoff re-accumulation pattern. The Wyckoff market cycle theory is used to predict the market’s direction, and it supports the idea that prices move in a cyclical pattern of four phases: accumulation, markup, distribution, and markdown.

These phases can reflect the investors’ behavior, thus possibly predicting future price movement.

Within the Markup phase price action moves in a long uptrend, and the re-accumulation phase is a sideways range that interrupts Markup with small consolidation patterns. After re-accumulation, prices start to move higher, but the support zone needs to hold strongly. Note the example by a pseudonym analyst:

Like so, Bishko believes that Bitcoin is following this same pattern, currently entering Phase D. If true and the price continues to replicate the movements, it could retest an ATH.

“Globally, Bitcoin is in a larger consolidation channel with a range of $30-67K. This consolidation is not a bear market until the price creates lower lows. Right now we see on the chart higher highs (HH) and higher lows (HL) on the higher timeframes(1d,1w).”

Related Reading | Data Shows Bitcoin Investors Afraid To Take Risk As Leverage Remains Low