The crypto space witnessed a historic moment yesterday with the approval of 11 spot Bitcoin Exchange-Traded Funds (ETFs), a development that’s been eagerly anticipated since the Winklevoss twins filed for the first proposed Bitcoin ETF back on July 1, 2013. This pivotal event coincides with the 15th anniversary of Hal Finney’s tweet “Running Bitcoin,” marking a symbolic milestone in the digital currency’s journey.

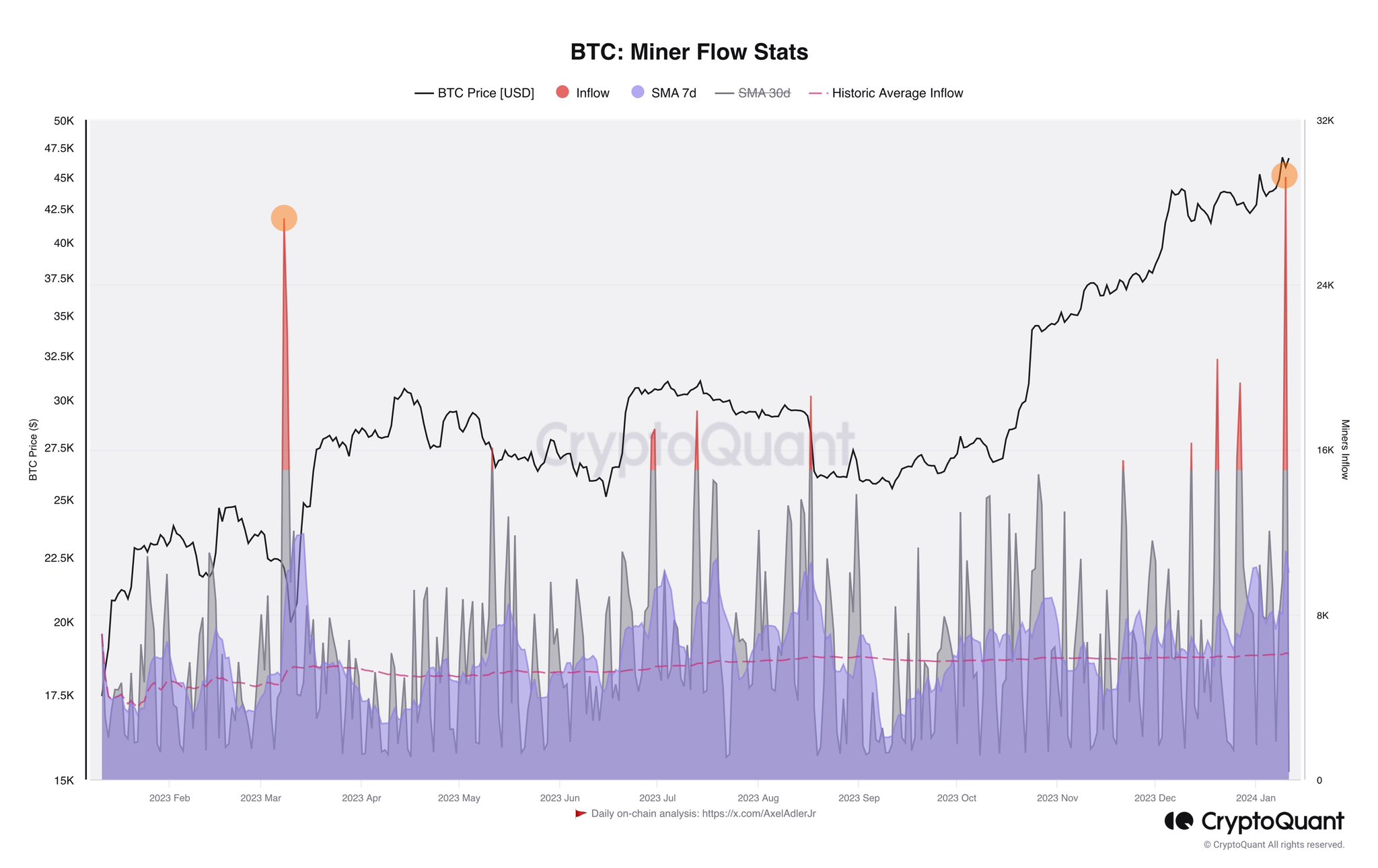

Despite the monumental approval by the US Securities and Exchange Commission (SEC), Bitcoin’s price reaction was muted, maintaining stability around the $46,000 mark. This suggests that the approval had already been factored into the market price. However, the landscape could shift dramatically with today’s commencement of trading for these ETFs.Spot ETFs, as opposed to future ETFs, necessitate the acquisition of physical Bitcoins by the issuers, thereby exerting direct buying pressure on the market. This aspect, combined with the high conviction among long-term investors (“hodlers”) and the historic low Bitcoin reserves on crypto exchanges, sets the stage for potentially volatile price movements.

Staggering Bitcoin Inflow Projections For Day 1

Projections for ETF inflows are staggering. Bloomberg a record-breaking $4 billion inflow on the first trading day for spot Bitcoin ETFs, with issuers collectively contributing $312.8 million in Bitcoin seeding. BlackRock’s ETF is particularly notable, with an expected $2 billion in inflows, as per Bloomberg Intelligence.Standard Chartered recently projected that 2024 could see $50-100 billion in spot Bitcoin ETF inflows, with a potential Bitcoin price reaching $200,000 by the end of 2025. Mike Alfred, a Bitcoin expert, commented on the potential scale of these inflows:

Tuur Demeester of Adamant Research the significance of the ongoing fee war among issuers, suggesting that the intense competition reflects expectations of substantial capital inflows. “The intensity of this Bitcoin ETF bidding war is telling me the issuers believe that the winner’s low fees will be compensated by HUGE $$ inflows,” he .Bitwise has confirmed they have $100M+ of investor commitments for tomorrow on day 1. I’m certain Blackrock is hoping for $3-4B. Invesco/Galaxy will also come out swinging. That’s a lot of corn. Hope the exchanges are ready.

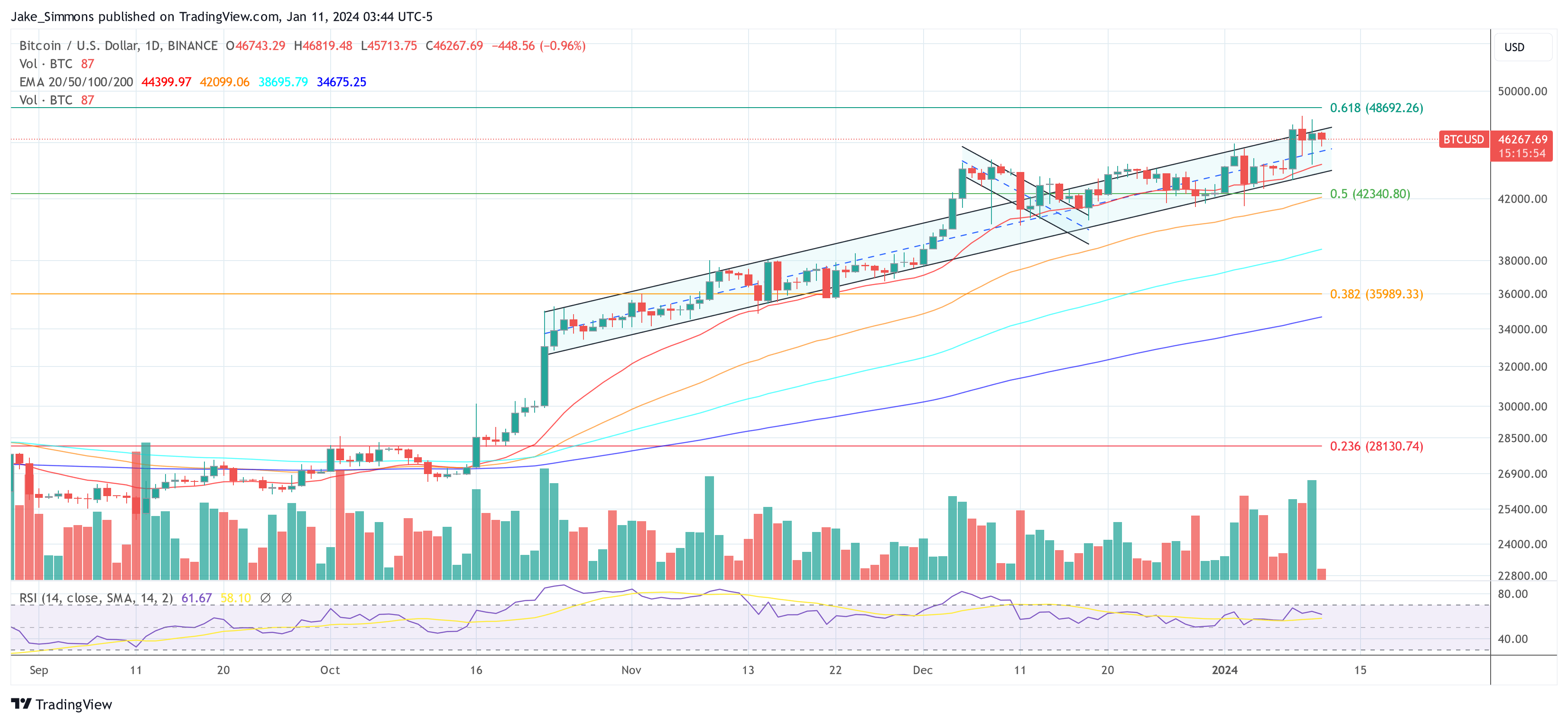

Next Target $50,000?

Raghu Yarlagadda, CEO of FalconX, in an interview with Bloomberg Technology, emphasized the crucial impact of net inflows on BTC’s price in the coming week:What we’ve been hearing is most people are pricing in net inflows into Bitcoin in the first week or so at $1 to $2 billion. So if the net inflows are less $1 to $2 billion, it will have an adverse effect on price, and if it is more than $1 to $2 billion, it will have a positive effect on price.

1/ Based on customer conversations, $1 to $2 billion of spot inflows in the first week are priced into Bitcoin at $45K. Inflows could be more with ETF fee wars beginning this morning. 2024 is setup well for crypto with ETF approval, BTC halving, Ethereum upgrade, and… — Raghu Yarlagadda (@2Ragu)British HODL, a known analyst on X, provided a deeper insight into the current market dynamics, explaining the lack of immediate price movement post-ETF approval and outlining scenarios for significant price changes depending on the inflows after the ETFs start trading. “For anyone wondering, Bitcoin price has not moved because: Leverage was wiped out yesterday, everyone who wanted in before the ETF, seems to be in. Only after 9.30am tomorrow can the ETFs actually start accepting capital and thus start acquiring Bitcoin,” he and added that if Bloomberg is right with $4 billion coming in on the first day, “we *could* see a price of $50k-$57k by close of trading on Friday. The buying pressure has not even STARTED yet.” At press time, BTC continued its sideways trend and traded at $46,267.