The All Exchanges Whale Ratio Soars

As pointed out by a CryptoQuant , the Bitcoin All Exchanges Whale Ratio had a sharp spike on Sunday. The BTC All Exchanges Whale Ratio is defined as the total amount of coins in top 10 transactions of all exchanges (that is, the transactions with the most BTC sent) divided by the total amount of coins flowing into the exchanges.Bitcoin All Exchanges Whale Ratio= Sum of Top 10 Exchange Inflow TXs (BTC) ÷ Total Exchange Inflows in BTC

The indicator shows the relative size of the top transactions to the total inflows on all exchanges. Based on which, it becomes possible to tell the ratio of whales that are using the exchanges.

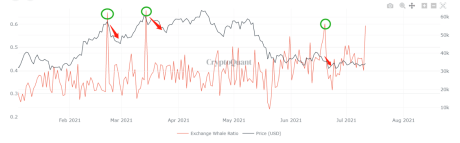

Now, here is how the Bitcoin all exchanges whale ratio chart looks like for the year 2021:

The BTC whale ratio seems to have risen | Source:As is clear from the chart, the value of the Bitcoin all exchanges whale ratio seems to have sharply increased recently. A notable feature of the graph is that the value of the indicator right now, about 0.6, has only been surpassed by three other occasions in the year.

Related Reading | Analyst: Bitcoin Approaches “Critical Intersection Of Macro Support”

Bitcoin Price

As of the time of publishing, BTC’s price is going around 33.5k, down almost 0.8% in the last 7 days. Compared to one month ago, its trading value is about 6% lower.

Here is a chart noting the trend in Bitcoin’s price over the last 6 months:

BTC's price seems to be on a downtrend | Source: BTCUSD on

The price of Bitcoin continues to be range bound as the crypto fails to escape the $35k resistance line. The volatility has dropped to the lowest of the year as the coin’s price stagnates.

Based on the behavior of the indicator this past year, the current spike in the BTC All Exchanges Whale Ratio might suggest that a drop in the price could be coming soon.Related Reading | TA: Bitcoin Prints Bullish Pattern, Why Close above $35K Is Crucial

It’s unclear how much the price would drop if the pattern indeed holds, and whether the market will enter a bear market afterwards. It’s also possible that a small dip could be there that’s followed by a long-term bull market.