On-chain data shows signs of dumping from the Bitcoin whales as the price of the crypto dips below $16k.

Bitcoin Exchange Inflow CDD Has Spiked Up In Recent Days

As pointed out by an analyst in a CryptoQuant , a large amount of dormant coins seem to have moved recently.

The relevant indicator here is “Coin Days Destroyed” (CDD). A coin day is the amount that 1 BTC accumulates after staying still in a single address for 1 day.

Whenever a coin that’s carrying some number of coin days finally shows movement, the coin day counter for it resets back to zero, and the coin days are said to be “destroyed.”

The CDD metric measures the total number of these coin days being destroyed across the entire supply at any given time.

A modified version of this indicator is the “exchange inflow CDD,” which tells us about the number of coin days being reset specifically because of transactions going into exchanges.

Here is a chart showing the trend in this Bitcoin indicator over the last few years:

Looks like the value of the metric has been quite high in the last few days | Source:

As you can see in the above graph, the Bitcoin exchange inflow CDD has spiked up to some pretty high values recently.

This means that investors have been sending in a large number of coins to exchanges, particularly coins that had previously been sitting dormant since a long while.

Also, it’s apparent from the graph that the latest levels of the indicator are the highest they have been since the spike back in July 2021, which occurred shortly before the bottom of the May-July mini-bear that year.

Large exchange inflows can have bearish effects on the price as investors may be depositing to these platforms for selling purposes.

Inflows from the long-term holders especially, who hold onto their coins for long periods and accumulate large number of coin days, could have noticeable consequences on the market since they are the cohort that’s least likely to sell at any point.

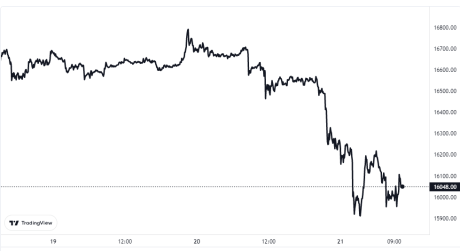

Following this recent spike in Bitcoin exchange inflow CDD, the crypto’s price has observed a decline below the $16k level, suggesting that it may be the selling from these whales holding old coins that’s behind the dip.

BTC Price

At the the time of writing, Bitcoin’s price floats around $16k, down 4% in the last week.

The crypto's value seems to have rebounded back above $16k for now | Source:

Featured image from Thomas Lipke on Unsplash.com, charts from TradingView.com, CryptoQuant.com