Bitcoin fell more than 7 percent on Monday after a whale deposited 18,000 BTC into a Gemini wallet.

The flagship cryptocurrency dropped to an intraday low of $54,568 at 0940 UTC, down 7.47 percent into the European session. Its correction started on Sunday after the price reached a new record high above $61,000. Traders used the refreshed peak to secure their profits, leading the prices lower. Nonetheless, the sell-off accelerated after the said Gemini deposit.A $1 Billion Bitcoin Sell-Order

Analysts across the cryptocurrency market interpreted the $1 billion transfer to the US exchange as a sign of a major dump ahead. CryptoQuant CEO Ki-Young Ju was quick to point out the . He published a chart that showed a spike in Gemini’s Bitcoin inflow on February 21, which followed a downside correction of more than 26 percent.

Markets selling off due to bogus data saying $1b of BTC flowing into Gemini. It's the 2nd time it's happened in the last 30 days. Chart: leverage positions getting liquidated as traders sell off. Red dots showing the timing of the fake inflows. (28k and 18k BTC respectively) — Willy Woo (@woonomic)

Analysts interpret massive inflows into cryptocurrency exchanges as a bearish signal. Traders typically transfer Bitcoin to their exchange wallets because they want to trade them later to rival cryptocurrencies or fiat currency. Conversely, they withdraw bitcoins from their exchange addresses if they want to hold the cryptocurrency.

Around $1.41 billion worth of long entries got liquidated in the last four hours, according to “rekt” data provided by .“This 18k BTC deposit is legit as it was a transaction between user deposit wallets and Gemini hot wallet,” noted Mr. Ju. “All Exchanges Inflow Mean is skyrocketed due to this deposit. Don’t overleverage if you’re in a long position.”

“Volatile Retest”

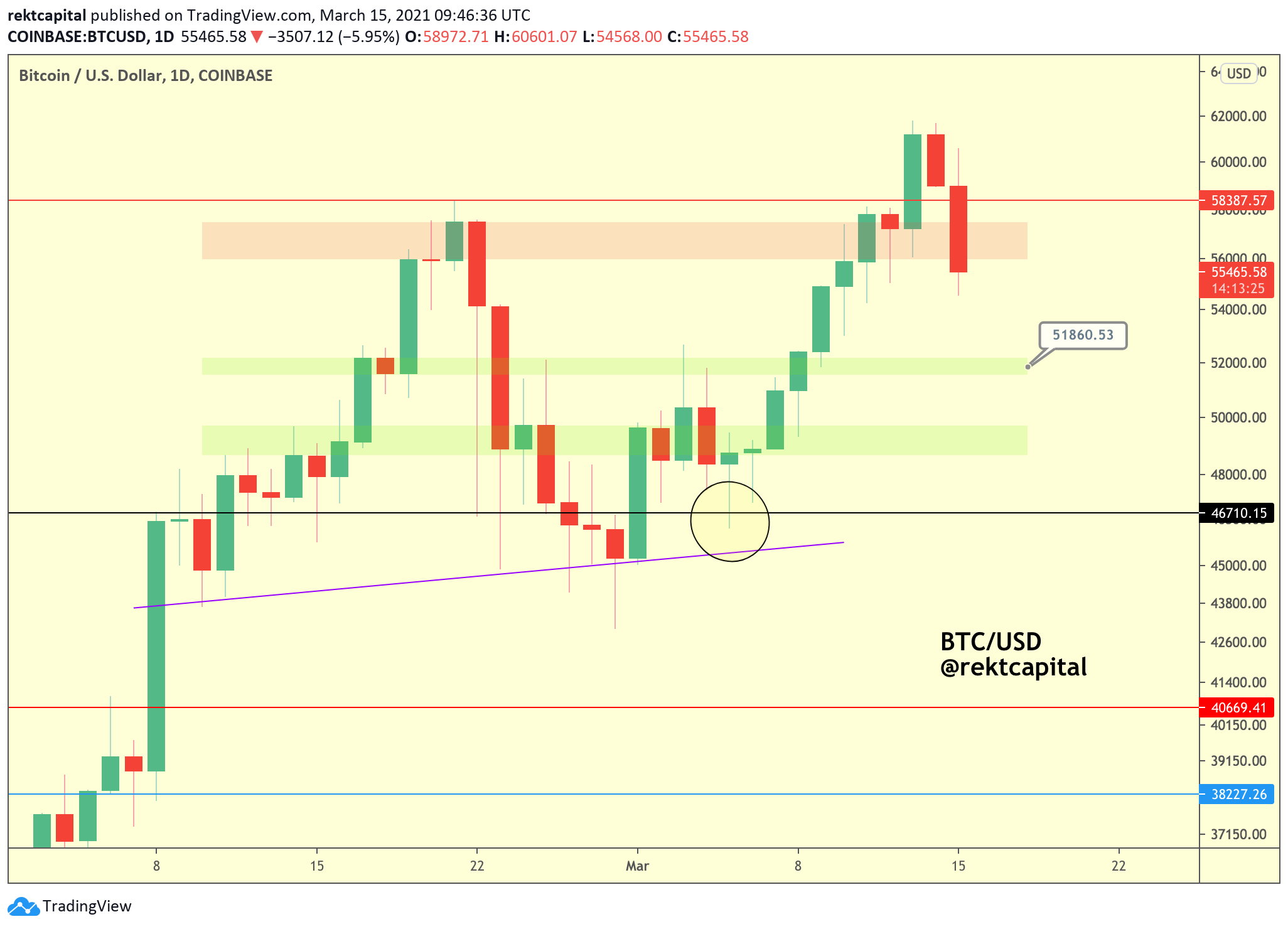

Technical chartists shifted their downside targets to the lower $50,000s following its sharp decline Monday. An independent analyst that the BTC/USD exchange rate could fall towards $51,860, a level that served as resistance during the pair’s rebound from the year-to-date low near $43,000. That is partly because of BTC/USD’s drop below its local support area around $58,000 (the redded range in the chart below).

Short-term, Bitcoin was testing its 50-day simple moving average wave as support.“The day is still young so [the] price could still resolve itself relative to this red boxed area and turn it into support,” the analyst added. “Technically, BTC is in the process of a volatile retest.”