Gold Outperforms As Russia Invades Ukraine

On Thursday the 24th of February, the world watched in horror as Russia began the first phases of its invasion of Ukraine. The latter which obviously possesses less military strength saw various parts of its country bombed by the Russian forces. But elsewhere on the charts, bitcoin and gold were having a battle of their own as investors watched with bated breaths.Related Reading | Russia Can Avoid Sanctions By Using A Wide Range Of Cryptocurrency Tools

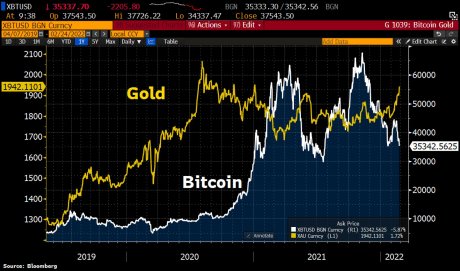

Gold outperforms BTC after Russia invades Ukraine | Source:The asset which had been trading as low as $1,892 per ounce the previous day had risen to as high as $1,970 on Thursday, where it peaked before declining. For that day, gold had emerged as the obvious winner between the two but this would prove to be only a temporary win.

Bitcoin Mounts A Takeover

Thursday came and gone and the markets once again began to settle by the end of the day. Bitcoin which had taken a beating on the 24th had bottomed out south of $34,000 before beginning another climb upwards.BTC recovers above gold on Friday | Source:As Thursday drew to a close, there was an obvious reversal trend between bitcoin and gold. While the latter had done well with the break of the news, the subsequent wave would see bitcoin once again being the dominant asset.

Related Reading | Bitcoin Monthly Cyclicality Paints Grim Picture For Last Week Of February

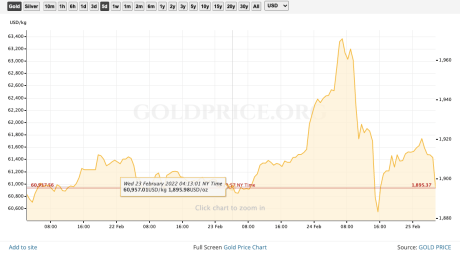

Gold had crashed back down towards $1,888 per ounce while bitcoin had recovered. The digital asset saw a price surge that saw its value come close to $40,000. Although the physicality of gold helps to promote faith in the asset, the ease of moving a digital asset like bitcoin can be a bigger reason to hold it as a hedge. As the week draws to a close, BTC remains on a recovery trend but gold has continued to decline.

Gold continues decline on Friday | Source:

Featured image from CoinWeek, chart from TradingView.com