Fidelity Digital Assets has released a new report citing the company’s investment thesis for the first-ever cryptocurrency: Bitcoin. According to the finance firm, the crypto asset is an “aspirational store of value.” They also call it an “insurance policy” that may protect wealth against “unknown consequences.”

Here’s why the cryptocurrency acts as the best insurance policy against several potential scenarios that all revolve around long-term wealth preservation.How Cryptocurrency Stacks Up Side-By-Side Against Gold

Before Bitcoin, there was no other asset like it. Several attempts to successfully create a digital form of currency failed at solving the double-spend issue that Bitcoin eventually overcame. Satoshi Nakamoto also sought to build a decentralized network underpinned by an asset that mimicked certain aspects of gold.

Related Reading | Gold Rally Peaks: 5 Reasons Bitcoin Will Likely Outperform The Precious Metal

The result is the creation of a non-physical asset that shares several similarities with the precious metal used to preserve wealth for generations. Not only does the cryptocurrency stand toe-to-toe with gold on many of its best features, but BTC was also designed to have benefits beyond what the precious metal offers.

The two assets performed neck and neck for the past two years. It is for all of these reasons combined, that Bitcoin makes for an ideal store of value and long-term preservation of wealth.

BTCUSD Versus XAUUSD Comparison Chart | Source:

Fidelity: Bitcoin Maturing To Become “Insurance Policy” For Long-Term Wealth Preservation

These two critical factors were recently pointed out in a new report from Fidelity Digital Assets’ . The firm’s “investment thesis” relies on the asset developing further as a store of value – for now, only being an “aspirational store of value.”“An emerging store of value grows purchasing power until it stabilizes. The key characteristics that are cited in reference to good stores of value are scarcity, portability, durability, and divisibility,” an excerpt from the report reads.

Chiefly, the report points to digital scarcity as the key component that gives Bitcoin its value as a potential long-term wealth preservation tool. However, the asset protects wealth in the long-term in a number of other critical ways.

Bitcoin existing beyond the reach of third-parties and governments may protect wealth from forms of intervention otherwise possible with today’s national currency system. For example, tax branches freezing assets to cover back-taxes.

Related Reading | How The US-China Capital War a Billionaire Warns Of Could Benefit Bitcoin

The asset may protect from the eventual collapse of the current fiat-based monetary system. Gold used to keep such a system stable, but unpegging the dollar in the 1970s began skyrocketing inflation and gold growing from $30 an ounce to nearly $2,000 today.

According to billionaire hedge fund manager, Paul Tudor Jones, the cryptocurrency reminds him of the role gold played back then. He also says Bitcoin is likely the “fastest horse in the race against inflation.”Fidelity cites the abundance of fiscal stimulus as a possible catalyst for further BTC growth. Additional points in the thesis outline the potential impact of deglobalization, and a great wealth transfer taking place amidst the pandemic.

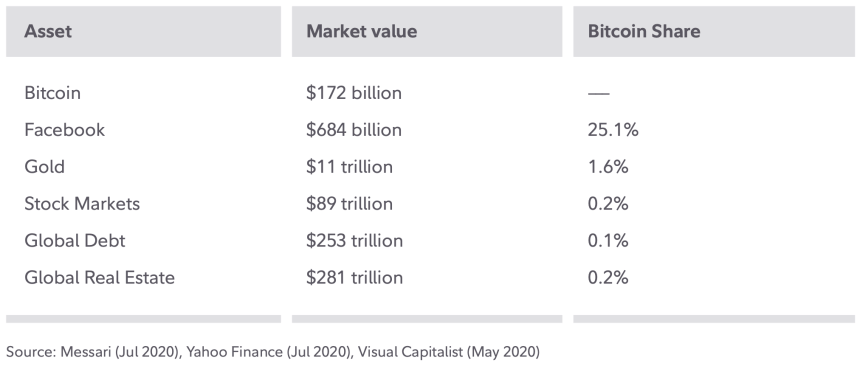

Market Cap Comparison | Source:There’s also an argument to be made on potential upside along comparative to other assets. Gold has an $11 trillion market cap. The stock market is $89 trillion. Global real estate tops over $281 trillion.

Bitcoin’s market cap is a meager $200 billion. With only 21 million BTC and trillions of dollars that could flow into the scarce asset, the upside per BTC is incredible. Yet as Fidelity’s report clearly lays on the line, it is only one of many reasons that Bitcoin makes the best “insurance policy” for “long-term wealth preservation.”