Franklin Templeton President and CEO Jenny Johnson joined CNBC’s ‘Squawk Box’ to discuss the firm’s spot Bitcoin Exchange-Traded Fund (ETF) offering in the US. In this interview, Johnson shared the reasons for investing in Bitcoin.

What Made Franklin Templeton CEO A Bitcoin Believer

As she states in the , the CEO is known for saying that “Bitcoin is the greatest distraction from one of the greatest disruptions in financial services,” which has led many people to believe that she doesn’t support or believe in the crypto asset.

Contrary to this belief, she points out that the Franklin Bitcoin ETF (EZBC) launch shows the asset manager company’s belief in BTC and blockchain technology.

Johnson cites the security that Bitcoin provides as one of the reasons that made her a “believer.” Holding and managing your private keys, which she states doing at one point, gives the asset what she labels an “insurance or safety component.”

This component makes crypto investors trust Bitcoin more since there’s a “fear component” linked to traditional assets, as she explains:

One of the things that made me a believer is: as I went around the world talking to people who would tell you ‘I keep 50% of my savings in Bitcoin because if I save the wrong thing in my country, I could have my assets confiscated.’ I remember talking to somebody in Israel who said, ‘My parents and their parents had all of their assets confiscated’ and they keep a portion in Bitcoin. So, there’s a fear component to it that it’s considered almost an insurance or safety component.

The CEO also listed the importance of Bitcoin in “fueling what is the next real opportunity in this blockchain world,” another reason for her to believe in the asset.

Trust In Blockchain Technology

Regarding the reason behind the market’s demand that led to the spot Bitcoin ETF’s approval by the US Securities and Exchange Commission (SEC), the CEO thinks that there are various reasons for it, including Bitcoin’s crucial role, “from a blockchain standpoint,” in the ability to pay.

Johnson further explained that blockchain technology will “open a lot of really interesting tech investment opportunities,” as Bitcoin is “one of the suitable opportunities here.” Furthermore, the CEO recalled the asset manager’s previous use and trust in blockchain technology:

We actually launched and tokenized money market fund. We’re the first mutual fund or the first traditional asset manager to actually launch a 40-act fund on a public blockchain, on the stellar blockchain.

Lastly, when asked what can allure a traditional investor to invest in an ETF, she explains there’s a market and use case for both. But while holding your keys can be ideal for many, it may also be complicated to figure out.

ETFs can better fit some investors who want to diversify their portfolio while “being able to open it up, have access through an ETF, and simply through your account.”

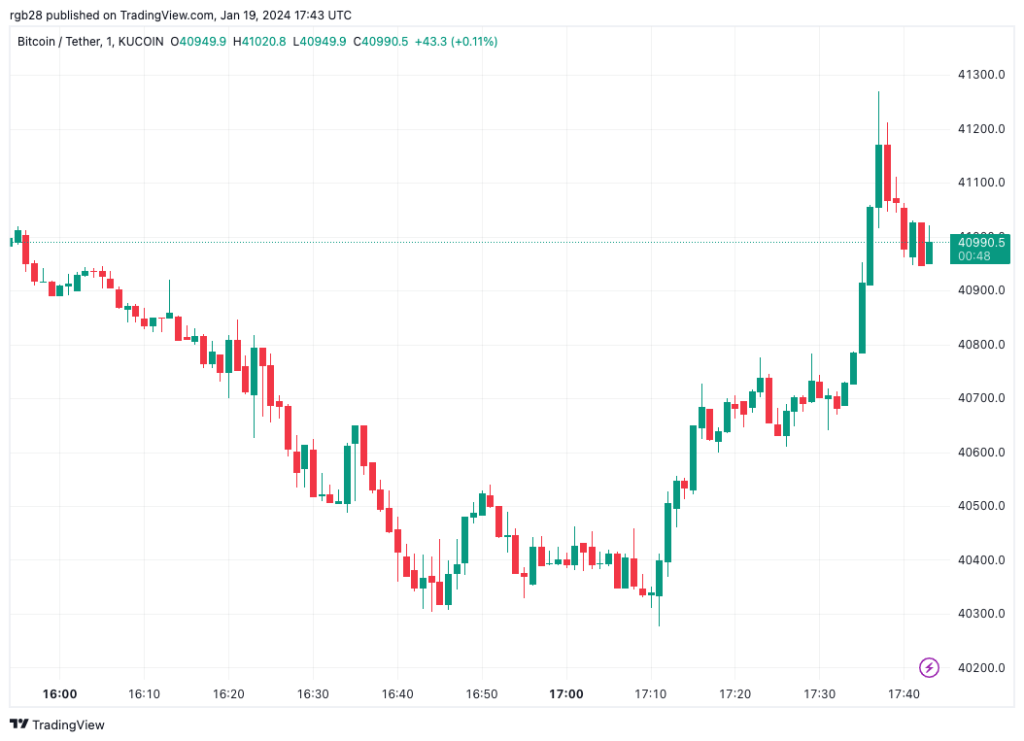

Bitcoin is trading at $40,990.5 on the hourly chart. Source: BTCUSDT on