Bitcoin Short-Term Holders Are Showing Elevated Exchange Inflows

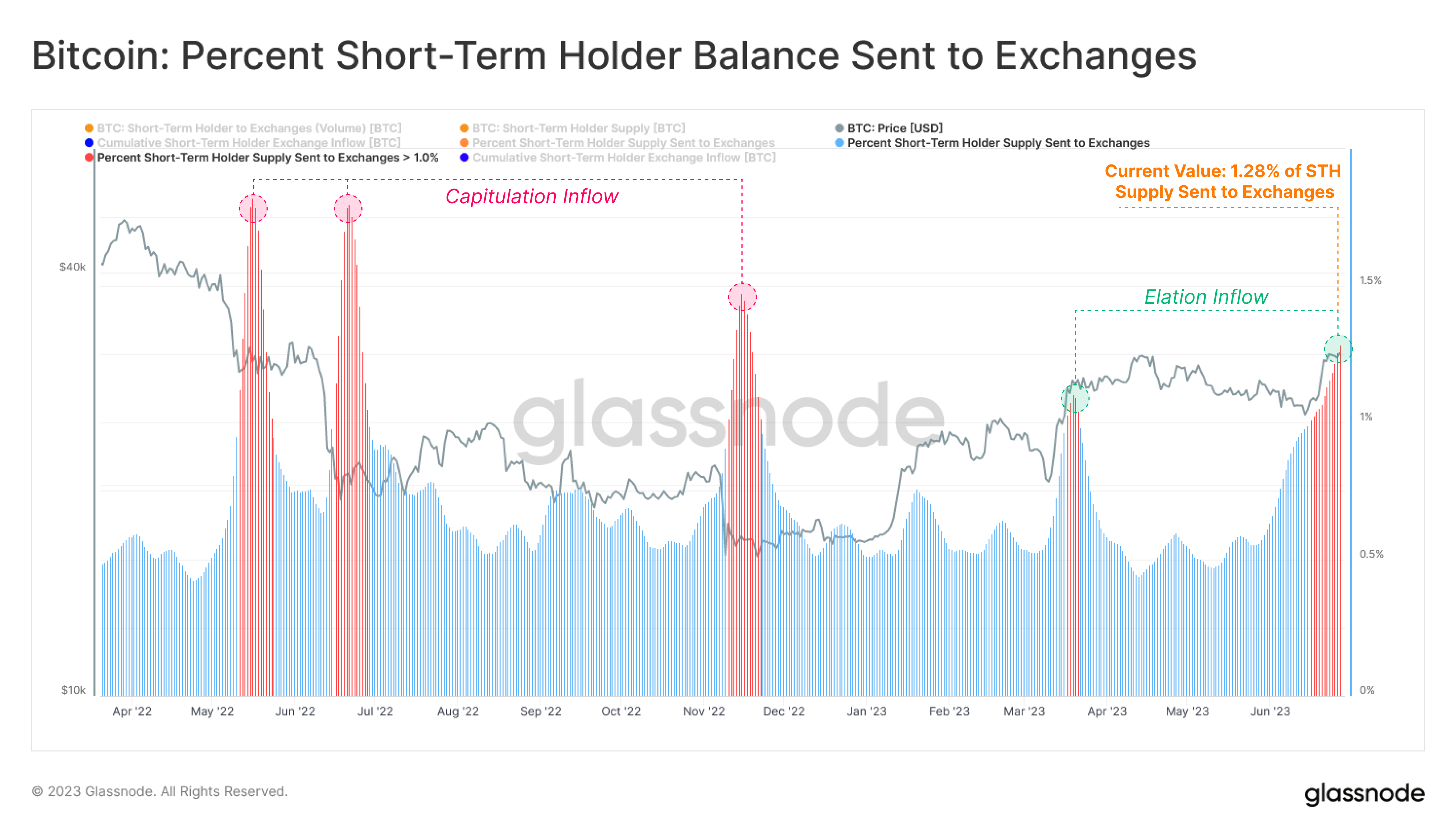

According to data from the on-chain analytics firm , the short-term holders have recently made inflows equivalent to 1.28% of their entire supply. The “exchange inflow” here refers to an indicator that measures the total amount of Bitcoin that investors are depositing to centralized exchanges currently.

Generally, investors deposit to these platforms for selling-related purposes, so whenever this metric’s value is high, it’s a possible sign that there is dumping going on in the market. Naturally, this kind of trend can have bearish consequences for the cryptocurrency’s price.The exchange inflow is usually defined for the entire market, but in the context of the current discussion, the focus is only on the inflows being made by the “short-term holders” (STHs).

The STHs make up one of the two major cohorts in the Bitcoin market (the other being the “long-term holders”), and they include all investors who have been holding their coins since less than 155 days ago. As their name already implies, these investors don’t tend to hold for too long, as they are usually the most fickle bunch in the market, easily selling at the sight of any FUD or profit-taking opportunities.The value of the metric seems to have been quite high in recent days | Source:

Here, the exchange inflow of the STHs is represented as a percentage of their supply (that is, the sum of the wallet amounts that each individual STH is holding right now). From the graph, it’s visible that the indicator’s value had risen to notable values earlier in the month when the market was going through FUD like the SEC lawsuits against cryptocurrency exchanges Binance and Coinbase.

BTC Price

At the time of writing, Bitcoin is trading around $30,100, up 4% in the last week.BTC continues to hold above the $30,000 mark | Source: