Bitcoin price is making its best attempt yet to climb back above $40,000 since the big crash in May. Thus far, the phrase “sell in May and go away” has worked like a charm, and it could take longer before buying coins back again is a profitable strategy.

That’s because the top cryptocurrency is struggling to hold above the middle-Bollinger Band, and if it can’t hold, it could result in another retest of the bottom of the band. Another retest could finally push the price per coin below support, making a clean sweep before a reversal.

Deja Vu: Why A Historic Move Could Be On The Horizon

For anyone who was around the crypto market during 2019, it feels like deja vu. At above $10,000, it wasn’t uncommon to see traders claiming the next stop was $100,000 or more. They were wrong, and Bitcoin crashed.

When it did, and sentiment shifted bearish, the cryptocurrency reversed with the third most profitable day on record. Anyone familiar with the October 2019 “China pump” knows that things can turn around fast, even when they seem at their worst.

Related Reading | Time To Pay Attention: Bitcoin Indicator Behavior Mimics Historic Rally

Indicators are primed in the same way and so is sentiment, and the latest rally following a morning star reversal and dragonfly doji serve up plenty of bullish signals.

Why then, are the Bollinger Bands warning of one more potential collapse – matching the China pump a lot more closely than the current price action.

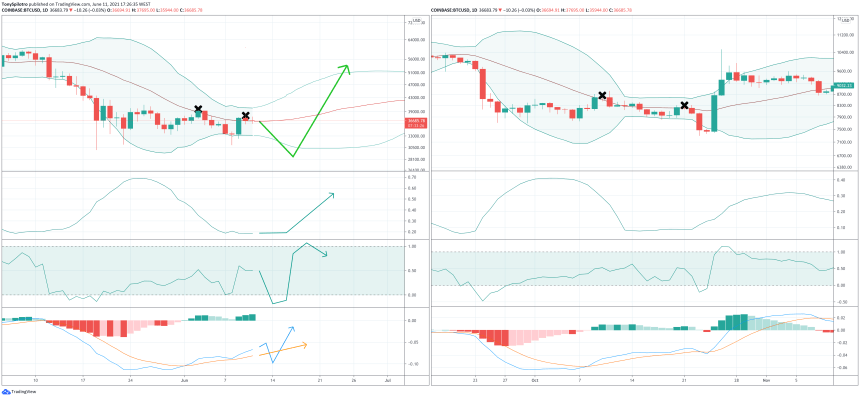

Could Bitcoin sweep lows one more time? | Source:

Bitcoin Price Could Slingshot Lower Before A Bounce Back To Highs

are a versatile technical analysis tool that measures volatility, highlights support and resistance, and much more. When the bands tighten or squeeze, it is a sign a massive move is coming ahead, and so far the tool is signaling something shocking should soon happen. But when?

Related Reading | Bitcoin Daily Dragonfly Doji Gives Bulls Hope Of Sharp Reversal

Not quite yet, if the middle-Bollinger Band – a simple moving average – is lost as support. During the prelude to the historic China pump, the middle-BB was lost not once but twice.

Indicators also match the last time Bitcoin got so confusing | Source:

Bollinger Band Width is at similar lows, but should hang there a while long. BB% could sweep the current low like it did in 2019 before slingshotting back upward.

Finally, the LMACD is also exhibiting a very similar pattern and if another bearish crossover happens, it could be a massive trap like the last time around. But for now, beware of one more sweep of lows before a reversal.

Featured image from Deposit Photos, Charts from TradingView.com