Bitcoin price today set a new all-time high, and tomorrow Coinbase goes public putting an even bigger spotlight on the already buzzing cryptocurrency industry.

Things couldn’t possibly look more bullish for Bitcoin and the rest of the market, but the recent price action could resemble one market wizard’s schematic of what “distribution” should look like. Here’s the chart that anyone bullish on Bitcoin might not want to see.The Various Phases Of A Crypto Market Cycle

All markets are cyclical, and crypto is no different. The entire asset class sans a few outliers are in a massive bull market where new all-time highs are set weekly.

Related Reading | Crypto CEO “Convinced” Of Bitcoin Cycle Top, Warns Of Sell Side Intensity

Throughout 2019 and 2020, the leading cryptocurrency by market cap was in full accumulation mode – a phase in which investors were loading up on BTC preparing for the bull market ahead.What comes next however isn’t as certain after coming so far. Unfortunately, what’s ahead might not be something bulls are yet ready to see.

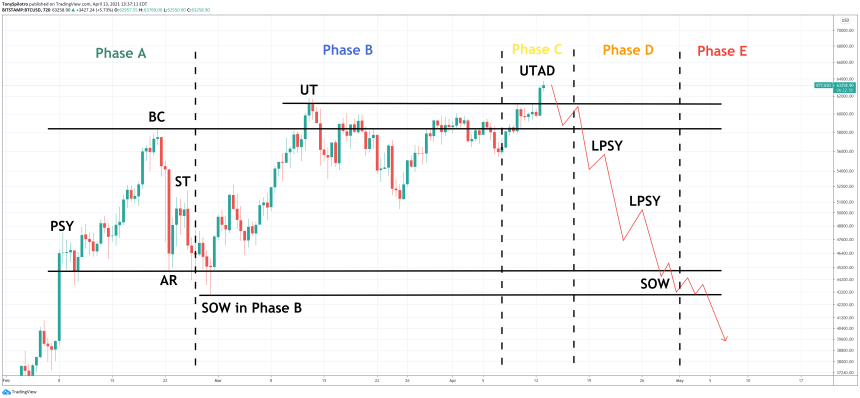

Recent price action matches the distribution schematic well | Source:

Recent Bitcoin Price Action Resembles Wyckoff Distribution Schematic

has spotted the fact that the recent price action in Bitcoin resembles a distribution schematic created by late master market technician Richard Demille Wyckoff. Wyckoff is alongside the likes of Gann, Dow, Dow, Elliott, Merrill, Morgan, and Livermore. His theories are regularly used throughout finance even today. Wyckoff theory believes that the market should be viewed as being controlled by one figured dubbed as “the composite man.” This mysterious whale takes the market through four distinct phases: accumulation, mark up, distribution, and mark down. Markets are said to cycle in such a manner, and Wyckoff was so keen to how this worked, he developed several schematics for each.Related Reading | Grand Finale: Bitcoin Price Closes Record High Weekly, Could Conclude Cycle

Layering such a schematic over the recent Bitcoin price action isn’t a great sign for bulls currently. Making matters much worse, the rally has been a full year strong now with very little correction, technicals are highly overheated, and a rare top signal just appeared for the first time since 2017.

If the analyst is right and distribution is why the rally paused at $60,000, what could come next is a mark down phase that erases some of the mark up over the last year – before it all starts over again.Featured image from Deposit Photos, Charts from TradingView.com