“Within something as important as the U.S. dollar, we need to move fast, but deliberately, because this is the highest possible stakes.”But he was quick to point out that the project is far from being a “done deal”. With that, he emphasized that the US has yet to consider all of the implications of a digital dollar fully. Above all, the project is just as much about considering these implications, as it is developing the technology.

“As the U.S. central bank, we need to understand all the tradeoffs that could exist if we were tasked to create a digital form of the dollar. That is the core of this project: How to have the most comprehensive map of tradeoffs for the American public if we are asked to create a digital dollar.”

Plans For a China Digital Currency Pilot Scheme Are in Place

Murmurs of a digital yuan have been doing the rounds for over three years at this point.

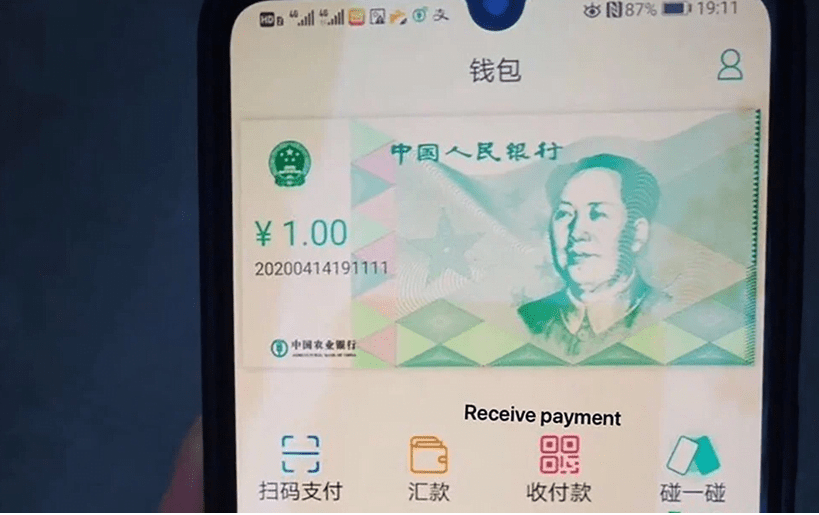

Alledged screenshot of China digital currency test app. (Source: )Two weeks ago, the Ministry of Commerce announced plans to roll out trials of the digital yuan. The cities involved are Shenzhen, Suzhou, Xiongan, Chengdu, Beijing, and Zhangjiakou.

Ripple Co-founder States It May Already Be Too Late

Co-founder and Executive Chairman of Ripple described the situation as a technological cold war. What’s more, this is a war the US can ill-afford to lose.“This is a major challenge to our country, and we must do everything we can to avoid losing our economic leadership.”Referencing SWIFT, Larson said the majority of the world’s financial infrastructure dates back to the 1970s. But a sea change is happening right now in blockchain technology and cryptocurrency that is opening up opportunities for challengers.

“For China, this is a once-in-a-century opportunity to wrest away American stewardship of the global financial system, including its ultimate goal of replacing the dollar with a digital yuan.”With that, China’s policy regarding blockchain is already streets ahead of the US. The imminent rollout of their national digital currency is just one indication of that. As such, Larson fears that the consequences of being slow will be wide-reaching. But ultimately, this may come down to the eventual loss of the dollar’s reserve currency status.