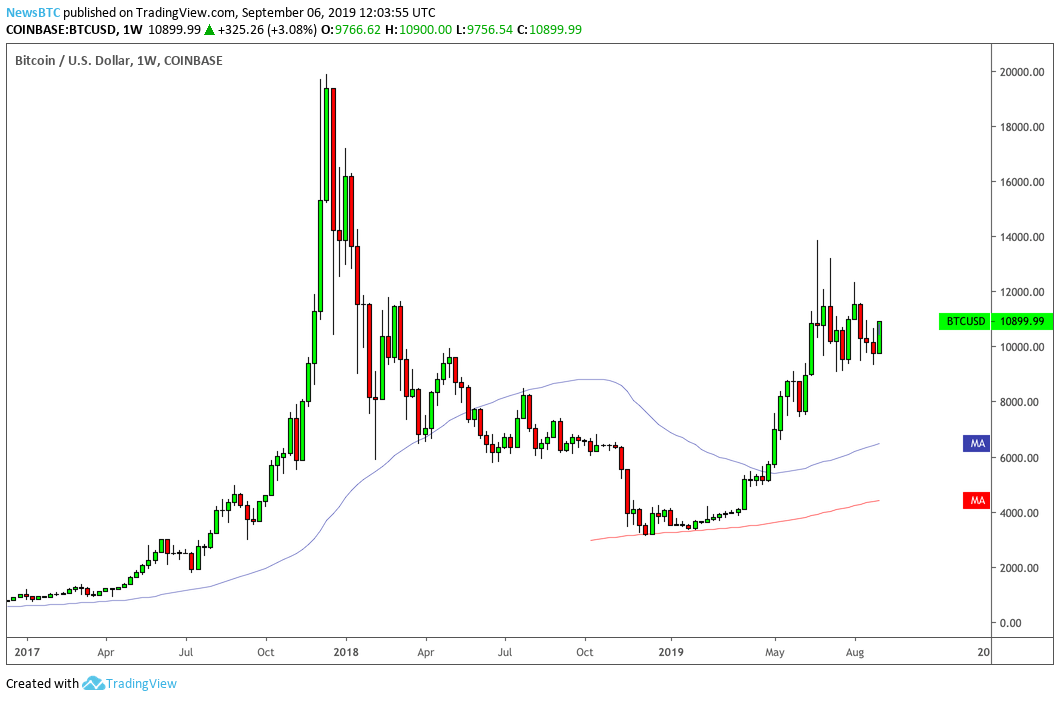

Fingers Crossed at $11,000

Speculators treat $11,000 as a make-or-break level, believing that closing above it could lead bitcoin towards the year-to-date high of $13,868.33, as recorded on Coinbase. On the other hand, the bearish side thinks rejection of an uptrend at $11,000 would lead the price back towards $9,000, a level which has been holding bitcoin from extending its interim bearish bias.“I’m [too] lazy to count how many times, but what is sure is that closing above it will be very bullish,” said Cleps while emphasizing majorly on the word ‘very.’//twitter.com/teddycleps/status/20819463 Another prominent analyst FlibFlib noted that Friday’s gains could pave the way for bitcoin to register broader profits during the weekend.

Bitcoin-Yuan Correlation

Bitcoin’s latest gains surfaced surprisingly on the day a Bloomberg report a strong correlation between bitcoin and yuan, stating that the cryptocurrency registered a record inverse relationship with China’s devaluating currency.

“There’s corroborating evidence for this, in that people in Asia were paying more for Bitcoin than elsewhere when the yuan fell,” Dr. Garrick Hileman, a researcher at the London School of Economics and ’s research director, told Bloomberg. “You can see it in the premium price paid sometimes for Bitcoin in exchanges like Huobi that primarily cater to Chinese.”

Investors have shown resilience towards yuan and the risk-on assets the national currency represents, especially after China and the US engaged themselves in a tit-for-tat tariff war. Yuan has fallen by more than 5.55 percent against the greenback from the day President Donald Trump announced the first tariff on the Chinese goods until the time of this press. That has prompted investors to take their capital into safe-haven assets.

Bitcoin, to many, is one of the hedging assets against the US-China trade war. Its correlation with yuan merely attests that investors are buying it, fearing that holding yuan would not be profitable. At the same time, to some, the bitcoin-yuan correlation is heavily misleading.“I wouldn’t comment on this would I not be constantly exposed to a whole inbidustry claiming how bitcoin is driven by gold/yuan/stocks/the dollar/etc,” believes Alex Krüger, a cryptocurrency analyst. “It often feels like mass delusion, not that different from the “this is a new paradigm, not a bubble” narrative of late 2017.”