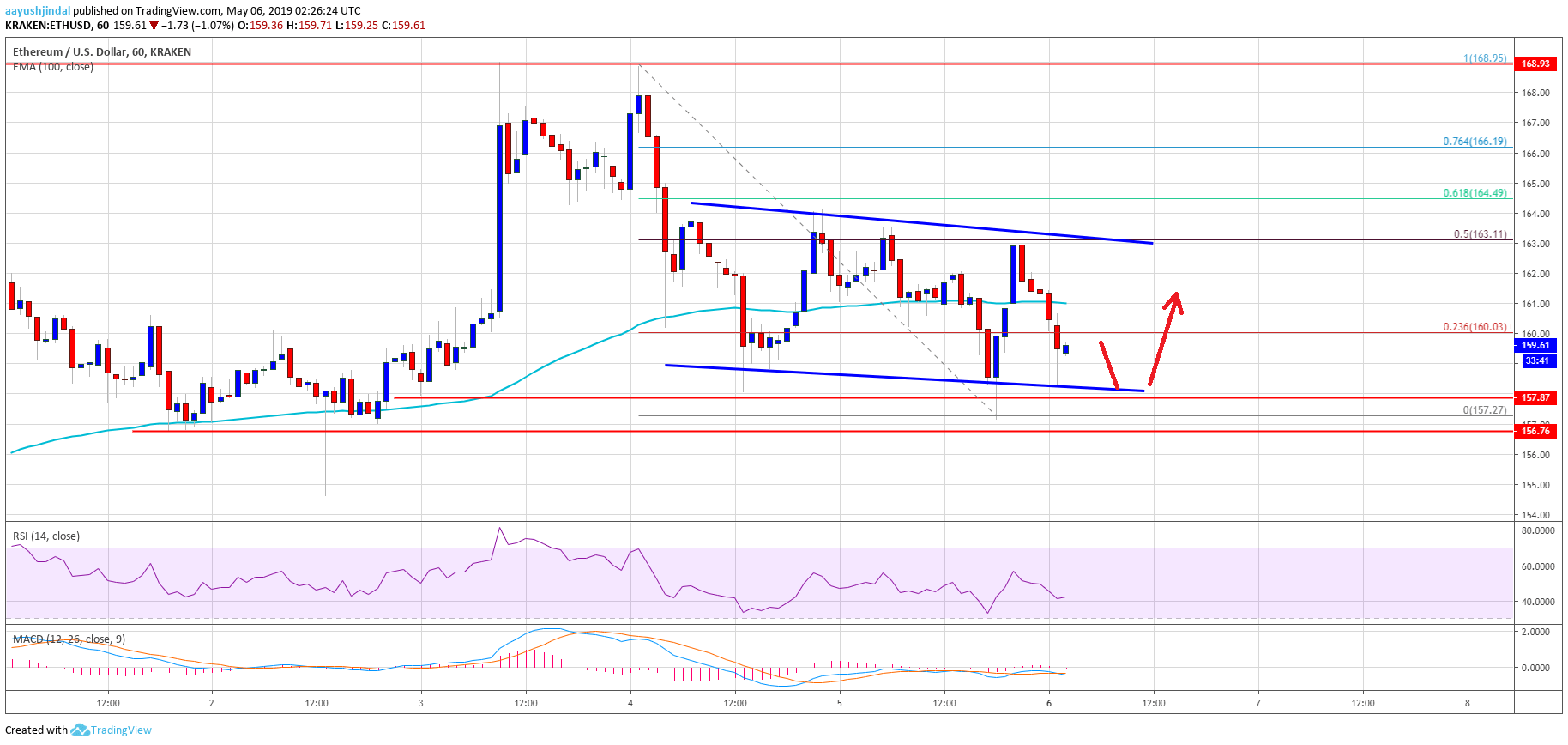

- ETH price corrected lower recently, but stayed above the key $156-157 support against the US Dollar.

- The price is facing a lot of hurdles near the $162 and $163 levels on the upside.

- There is a short term declining channel in place with resistance near $163 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must stay above the $156 support to avoid a downside break in the near term.

Ethereum price is facing a lot of selling interest versus the US Dollar and bitcoin. ETH could bounce back above $163 as long as the $156 support area is intact.

Ethereum Price Analysis

Recently, there was a decent upward move above $165 in Ethereum price against the US Dollar. The ETH/USD pair spiked towards the $170 resistance, but it failed to hold gains. There was no clear break above the $168-169 resistance zone. As a result, there was a downside correction below the $165 and $163 levels. The price even broke the $160 level and the 100 hourly simple moving average. However, the $156-157 support area acted as a strong buy zone.

The price recently traded above the $162 level, and the 23.6% Fib retracement level of the last decline from the $169 swing high to $157 swing low. There are recovery signs visible, but it seems like the $163 level is acting as a significant resistance. It also represents the 50% Fib retracement level of the last decline from the $169 swing high to $157 swing low. At the outset, the price is moving lower and trading just above the key $156-157 support area. If the bulls fail to defend the $156 support area, there is a risk of a sharp decline.

The next key support is near the $155 level, below which Ether price could decline towards the $150 support level. On the upside, the price must clear the $163 level to start a decent upward move. There is also a short term declining channel in place with resistance near $163 on the hourly chart of ETH/USD.

Looking at the , Ethereum price may trade in a range above the $157 support for some time before the next break. The chances of a fresh increase are high as long as bitcoin price is gaining strength. If there is a downside break below $155, it could put a lot of pressure on the bulls in the near term.

ETH Technical Indicators

Hourly MACD – The MACD for ETH/USD is currently in the bearish zone, with a few negative signs.

Hourly RSI – The RSI for ETH/USD recently declined below the 50 level, but holding the 40 level.

Major Support Level – $157

Major Resistance Level – $163