- Litecoin prices drop 10 percent

- CoinBase teaming with Visa will drive adoption

Not only is CoinBase aggressively listing digital assets and departing from their cautious approach, but they are also busy partnering, opening doors allowing their users to spend their Litecoin balances thanks to their collaboration with Visa. Meanwhile, prices are dropping and may retest $70 and even $60 in a correction phase.

Litecoin Price Analysis

Fundamentals

The correlation between Bitcoin and Litecoin is direct. Although it may not be one according to math done by CoinPredictor, the correlation coefficient of their prices is 0.58. That’s more than 50 percent and is therefore significant. Therefore, any spike or drop of Bitcoin will likely force liquidation in Litecoin and many other coins. We saw that behavior last year, and even as prices recover, the light liquidity behind Litecoin means it is leading.

However, what is interesting are fundamental developments. Active wallet addresses are increasing and so are institutional involvement. As we know, any injection of funds by any of the prominent institutional grade participants translate to confidence. Fidelity would participate in providing custodial solutions and so will CoinBase. It is not in custody alone. CoinBase plans to be a broker-dealer while acting as an exchange supporting Litecoin.

What is interesting though is their with Visa. Visa is a centralized payment processor and the largest in the world. Therefore, their collaboration with CoinBase allowing users to spend—rather than hold their Bitcoin, ETH, XRP and Litecoin balances across millions of Visa supporting points across the globe, is a guaranteed path towards mainstream adoption and demand.

“This is the first debit card to link directly with a major cryptocurrency exchange, allowing people to spend their crypto balances direct from their Coinbase account. Previously available crypto cards required users to pre-load a specified amount of crypto onto their card, adding a point of friction to the process.”

Candlestick Arrangements

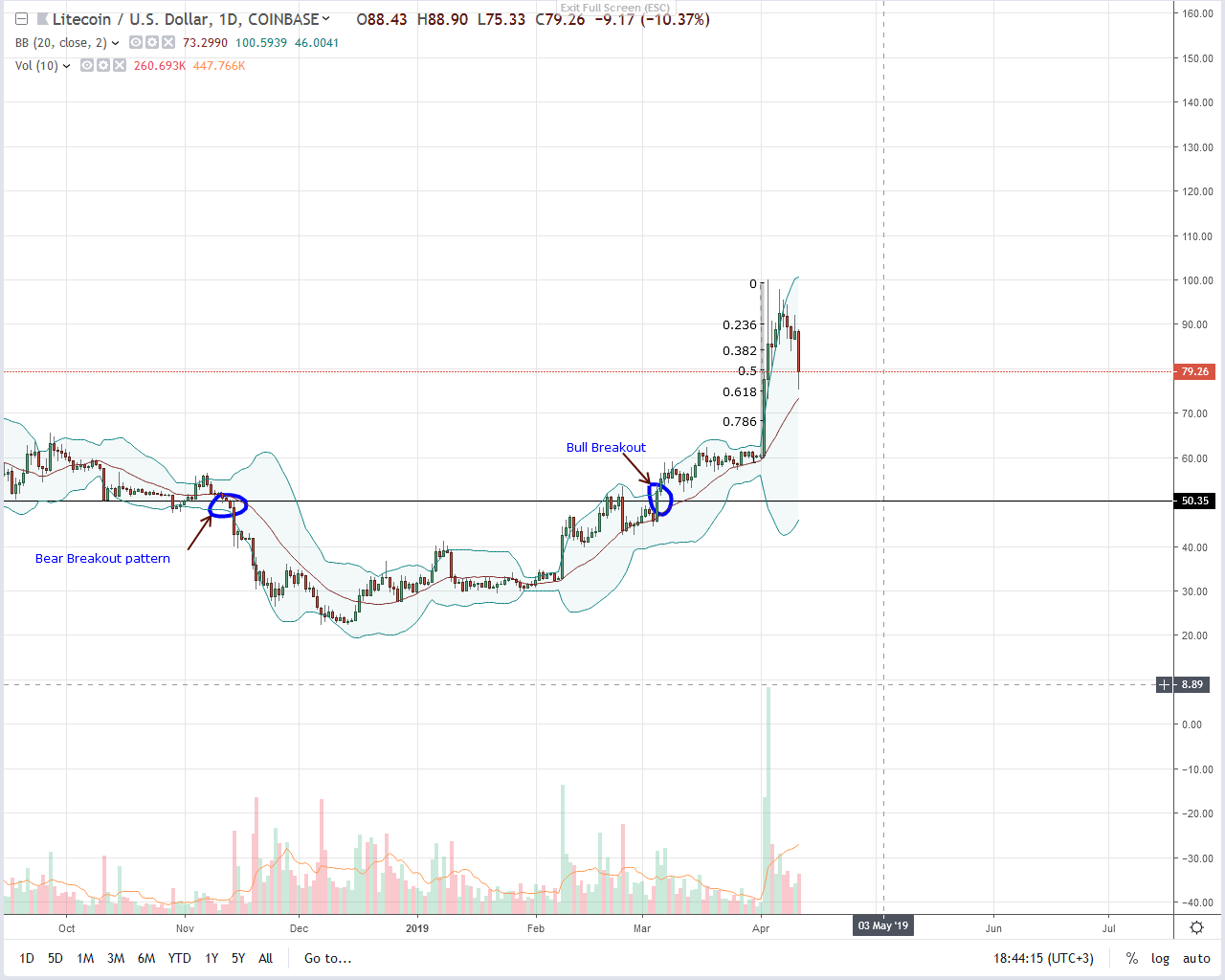

Price wise and Litecoin (LTC) buyers are slowing down, shedding 10 percent in the last day. It may be a double-digit slump, but considering the coin’s super rally during the previous three months when buyers’ momentum breached $50 invalidating the bears of Nov 2018, a correction was due—and it is happening as press time.

Note that we have a three-bar bear reversal pattern. Today’s bar is wide-ranging hinting at sell momentum confirming bears and simultaneously correcting the coin’s overvaluation of Apr 4-6.

In that case, we expect support at around the 61.8 and 78.6 percent Fibonacci retracement level of the last leg up in a retest before bull trend resumption towards $90.

Technical Indicators

Our anchor bar is Apr-3 with 1.46 million. Even though it is bullish, it is above the upper BB with a long lower wick pointing to over-extension. For our bullish stand to be valid, any drop towards $70 or $60 should be with light volumes below 1.46 million of Apr-3 or 750k of Apr-2.

Chart courtesy of Trading View